2018 Tax Rate Malaysia

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020.

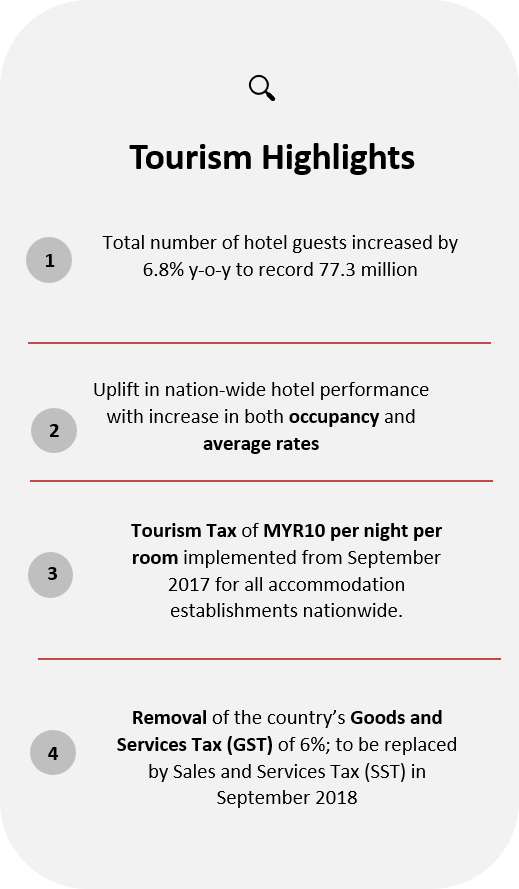

2018 tax rate malaysia. Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. The sales tax is being reimposed to reassure financial markets that the country can cope with the lose of the gst revenues the planned high speed railway link to singapore has already been cancelled because of fiscal concerns. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower.

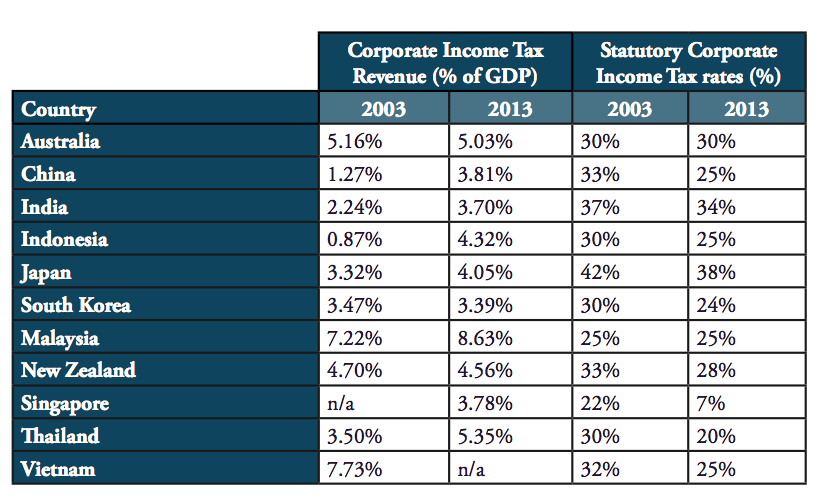

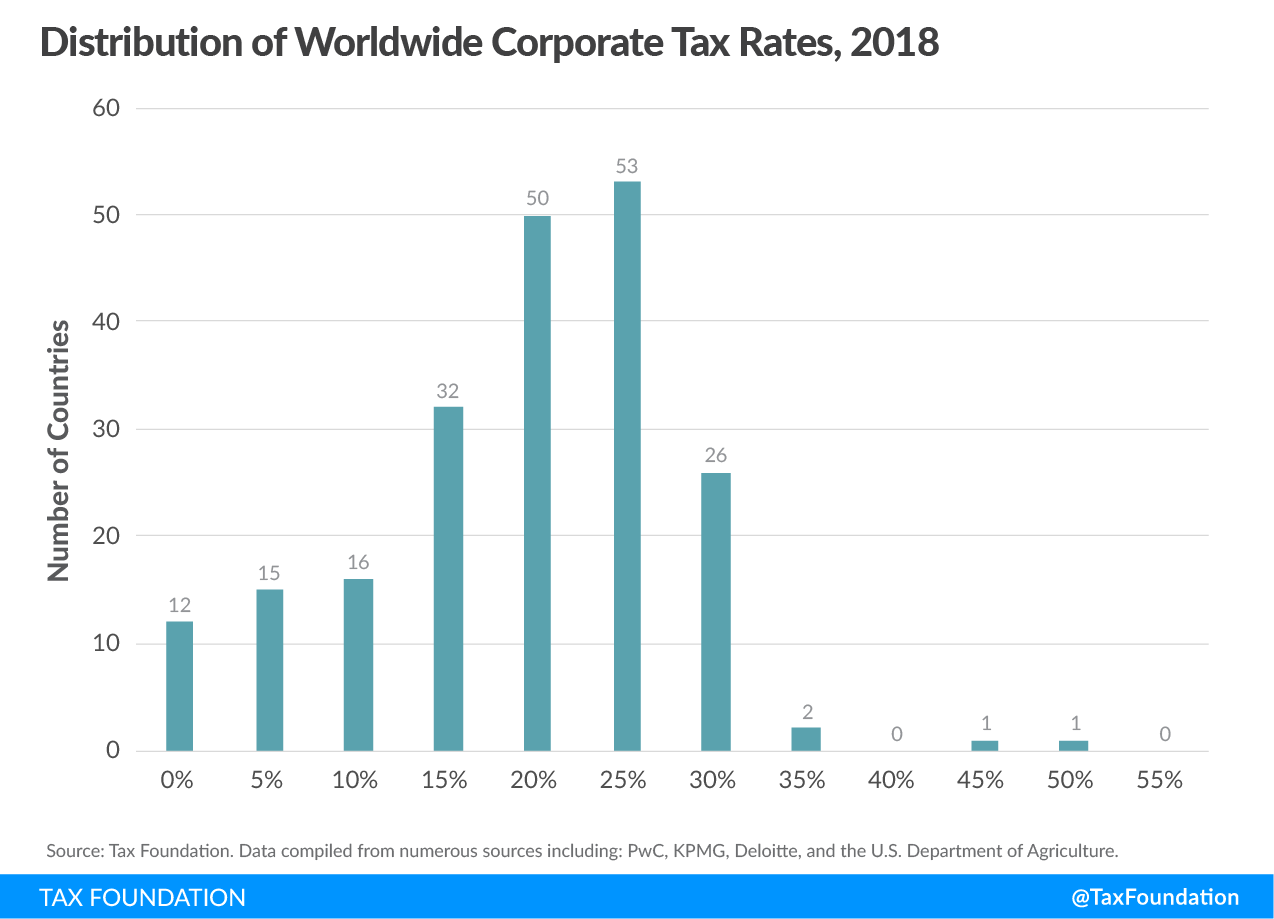

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Semua harga di atas akan dikenakan cukai perkhidmatan malaysia pada 6 bermula 1 september 2018. Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Calculations rm rate. Malaysia is to reintroduce its sales and services taxes sst from 1 september 2018 with a likely standard rate of 10. There are no other local state or provincial government taxes on income in malaysia. No other taxes are imposed on income from petroleum operations.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. 2018 2019 malaysian tax booklet 23 an approved individual under the returning expert programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in malaysia for 5 consecutive yas. Tax rm 0 5 000.