2018 Income Tax Malaysia

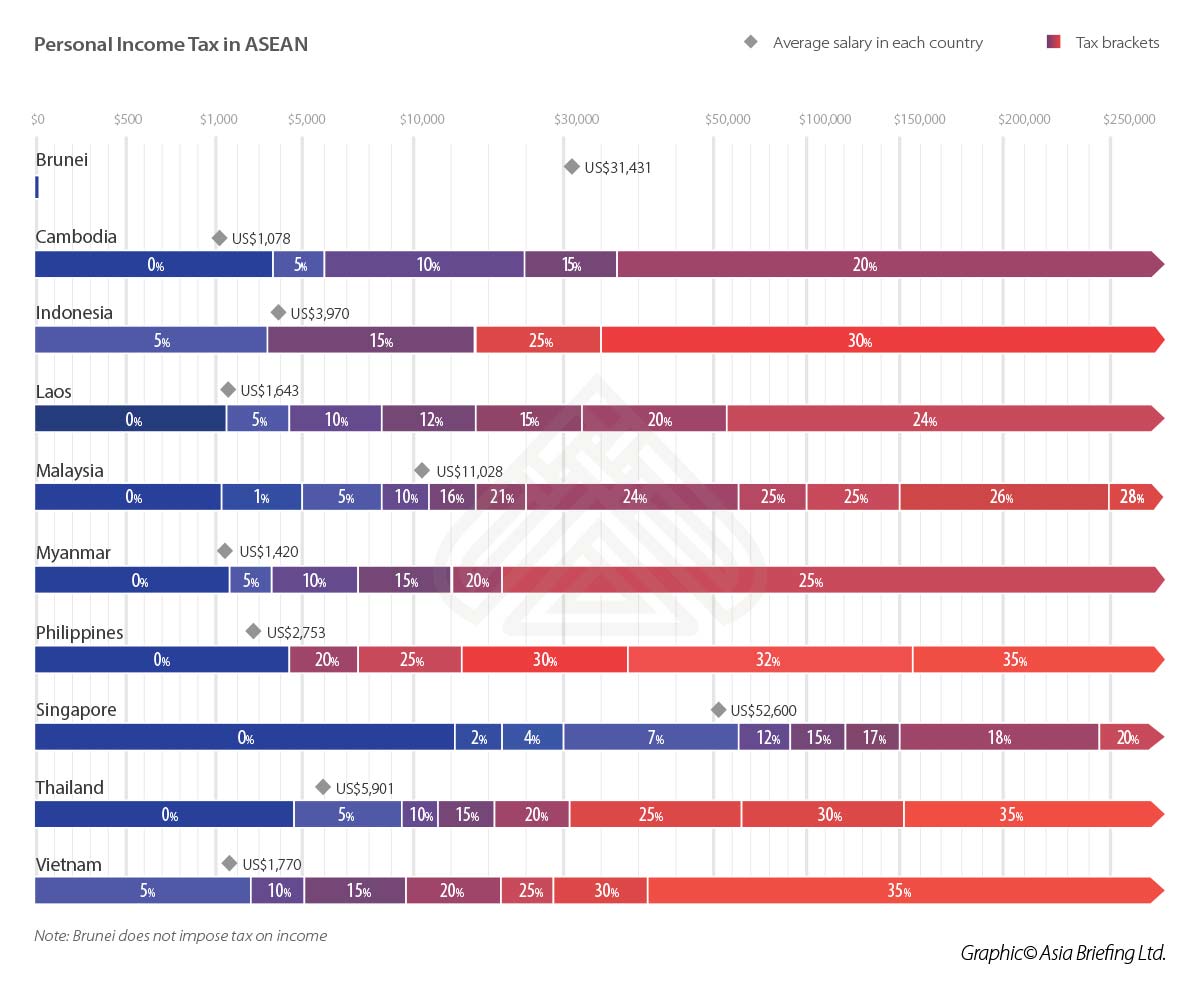

What are the income tax rates in malaysia in 2017 2018.

2018 income tax malaysia. Calculations rm rate. What is income tax. Malaysia has a fairly complicated progressive tax system. Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing.

5 derivation of business income business income is subject to tax in malaysia if it is derived or deemed to be derived from malaysia. On the first 5 000. Tax rm 0 5 000. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018.

Income tax is a type of tax that governments impose on individuals and companies on all income generated. 2018 2019 malaysian tax booklet 23 an approved individual under the returning expert programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in malaysia for 5 consecutive yas. 2018 2019 malaysian tax booklet. Any income which is not attributable to operations of any business carried on outside malaysia shall be deemed to be derived from malaysia.

Prior to jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption. Labuan business activity tax amendment bill 2018 highlights. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. 1 corporate income tax 1 1 general information corporate income tax.

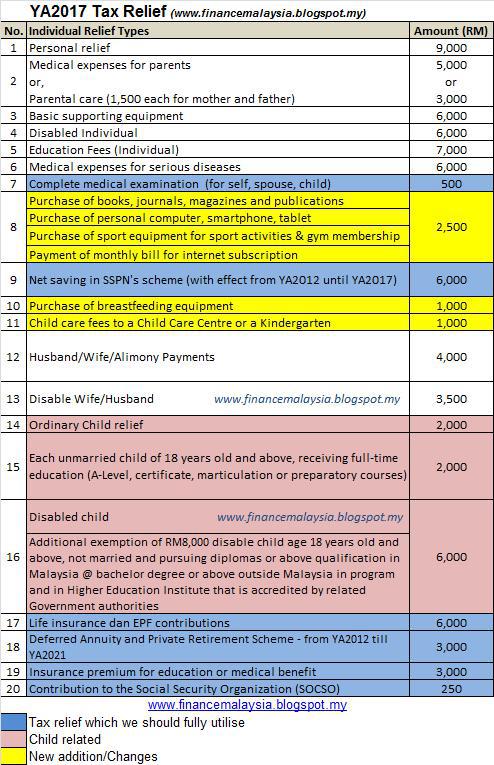

Total deposit in year 2018 minus total withdrawal in year 2018 6 000 limited. There are a total of 11 different tax rates depending on your. Who needs to pay income tax. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

There s a lower limit of earnings under which no tax is charged and then a progressively higher tax rate is applied based on how much you earn above that level. Receiving further education in malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to. Special tax rates apply for companies resident and incorporated in malaysia with an ordinary paid up share.