2017 Income Tax Malaysia

As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure.

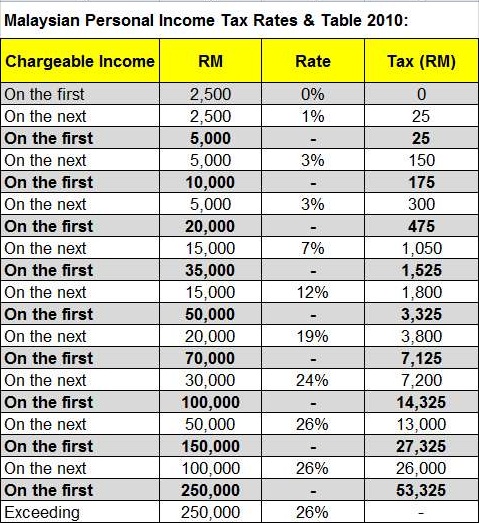

2017 income tax malaysia. You ll be charged a flat rate on any taxable income of 28. Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable income for two years with both of the years having an accounting period of 12 months with the same. On the first 2 500.

Calculations rm rate tax rm 0 5 000. Calculations rm rate tax rm 0 5 000. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. Source 17 december 2017.

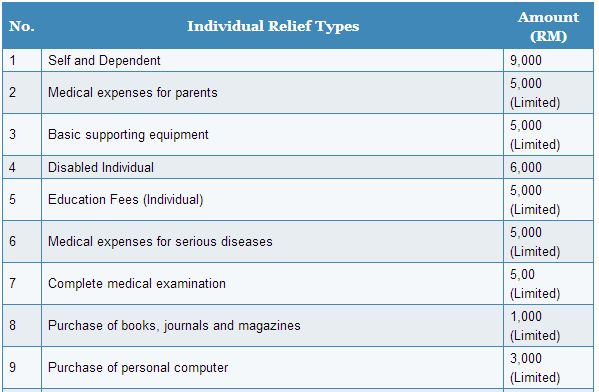

Home income tax rates. Income attributable to a labuan. Income tax relief malaysia 2018 vs 2017 unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act.

On the first 5 000. 8 june 2017 income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances public ruling no. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

No guide to income tax will be complete without a list of tax reliefs. Inland revenue board of malaysia income tax treatment of goods and services tax. A much lower figure than you initially though it would be. Clarification regarding the imposition of 100 penalty for failure to declare income and correct information the clarification states that as from 1 january 2018 the irb plans to apply a penalty equal to 100 of the tax payable on undeclared or under declared income in the case of certain tax offenses.

If you re a non resident taxpayer the system is a little more straightforward but also more expensive. In fact there is only one minor change which applies to the medical expenses and examination of the individual spouse or child. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of. Technical or management service fees are only liable to tax if the services are rendered in malaysia.

Of course these exemptions mentioned in the example are not the only one. Rm 63 000 rm 1 400 rm 9 000 rm 4 400 rm 48 200.