Bank Islam Home Loan Rate

Malaysia housing loan interest rates.

Bank islam home loan rate. List of campaign winners. Bank islam s profit rates are also among the highest among islamic banks in malaysia. Profit rates effective 01 september 2020 to 30 september 2020. Bank islam will never request for internet banking account updating via e mail or disclosure of customers personal identification number login id password and i access code to third parties under any circumstance.

Applicant covered by takaful protection. Bank islam debit card i. Get a higher financing entitlement of property value. Report any suspicious activity at 03 26 900 900.

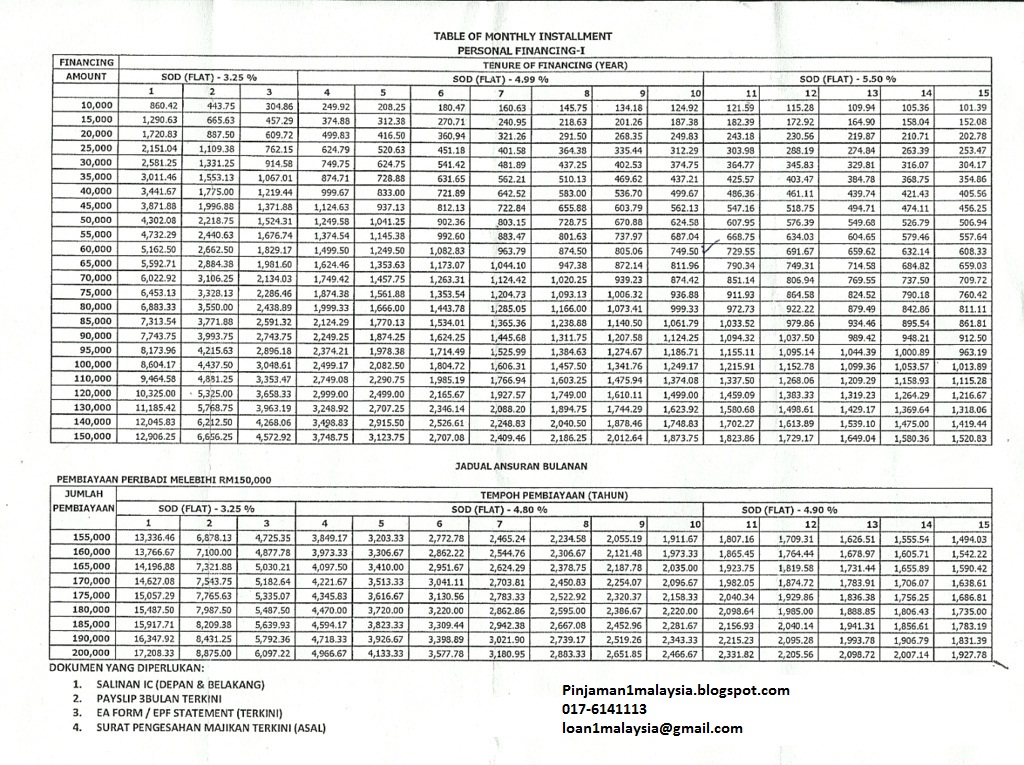

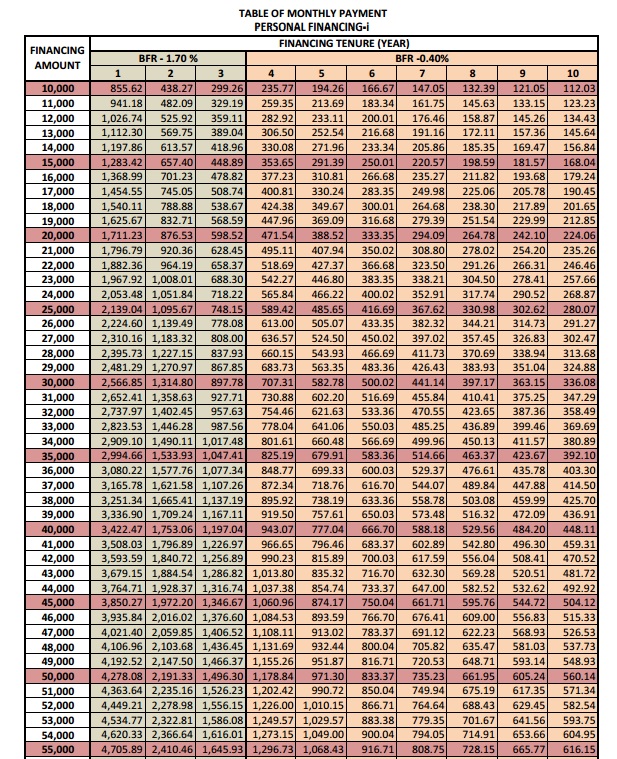

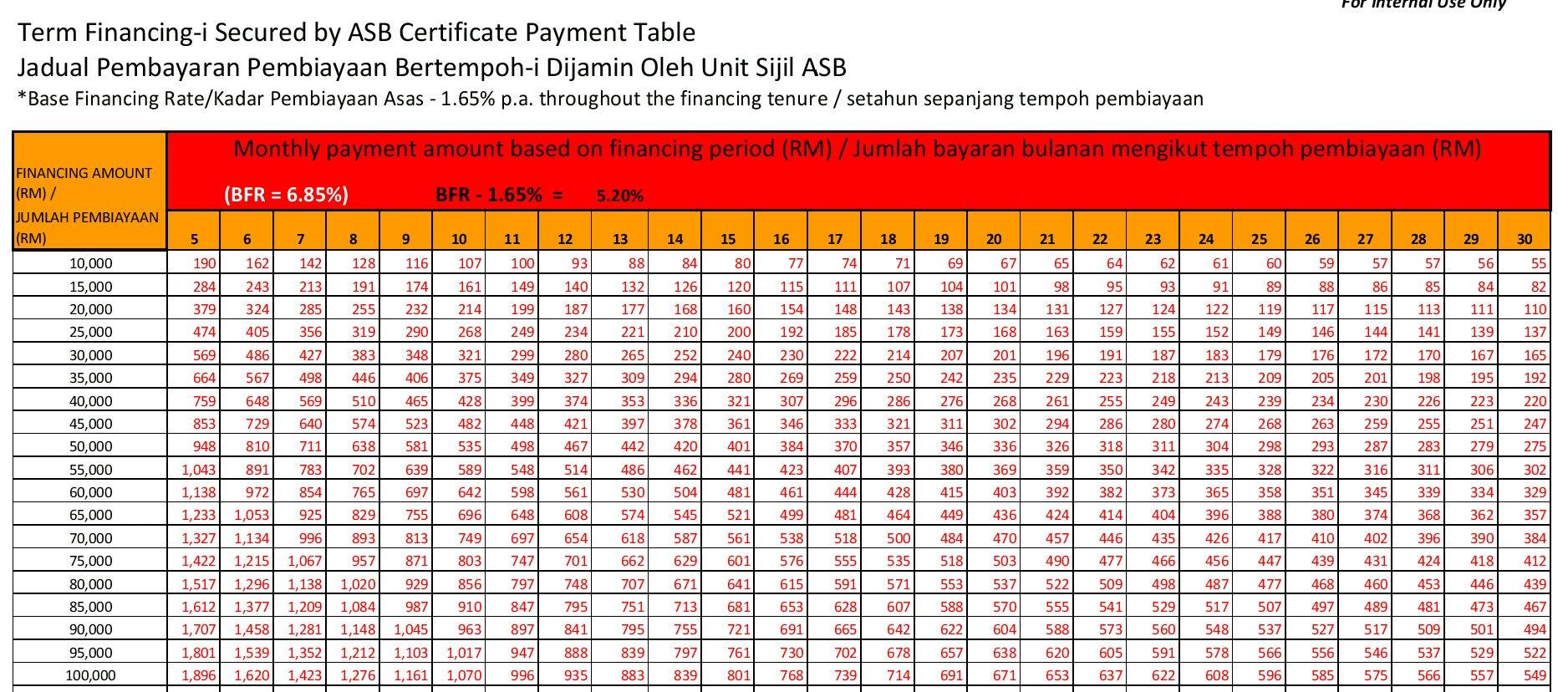

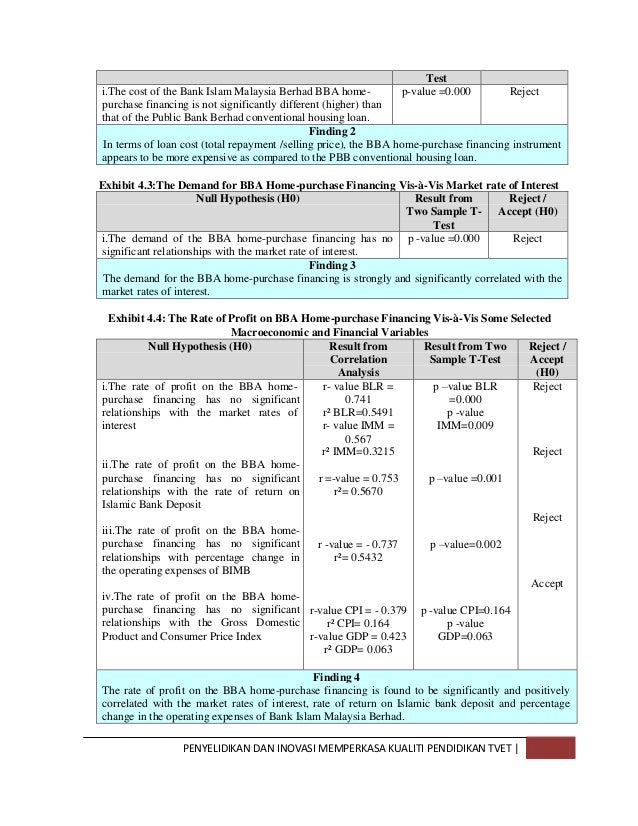

Approved loan amount of up to rm200 000. Enter loan interest rate in percentage. Indicative effective lending rate for bank islam malaysia is 3 25 with effective from 10 july 2020. Profit rates from 16 august 2020 to 15 september 2020.

What is an islamic mortgage. The lender will ask you for much of the same information as it would when applying for phh mortgage heloc a mortgage. Guide for consumer on reference rate. Bank islam refinance home loan applying for a home equity loan is similar but easier than applying for a new mortgage.

Dont act upon spoof e mail. Secure attractive financing rates based on how much you can afford in payments. Guarantor rights and obligations. In order to qualify for a sharia mortgage you ll typically need a deposit of at least 20 of the property.

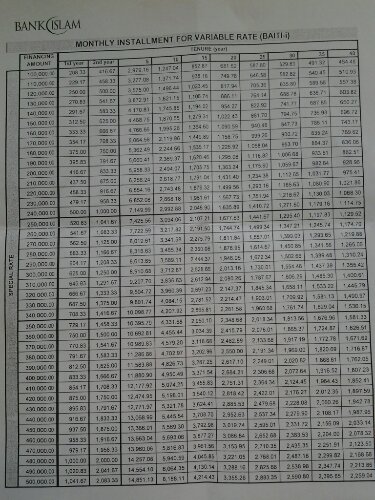

Base lending rate blr 6 6 maximum loan amount 90 of property price. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period. These mortgages differ from traditional home loans in that they don t involve paying interest as that s forbidden under sharia law. Bank islam credit card i.

Interest rate starting at 4 99 per annum. In case of an early full redemption you can expect to pay up to 4 on your outstanding financing amount as a penalty fee. A maximum total debt service ratio tdsr of 70 for those with net income of bnd 1 750 00 and above subject to bank s policy. Each lender will follow roughly the same steps when assessing your application.

An islamic mortgage is one that s compliant with sharia law.