Benefit In Kind Public Ruling

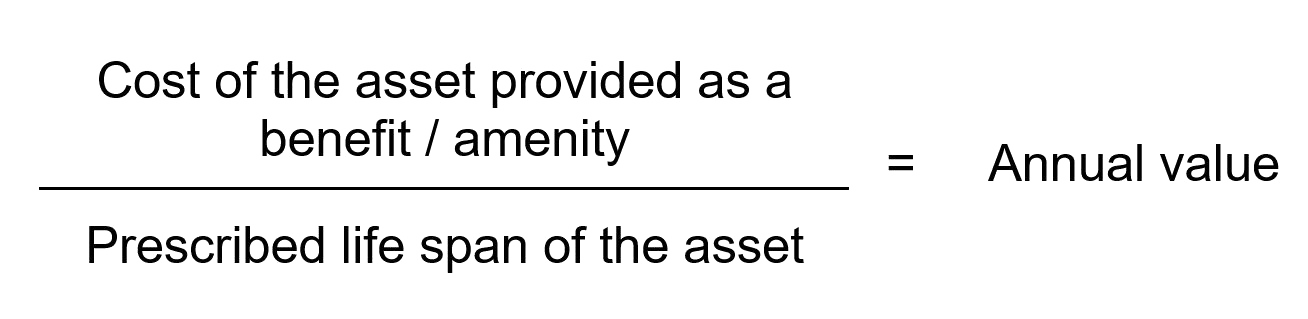

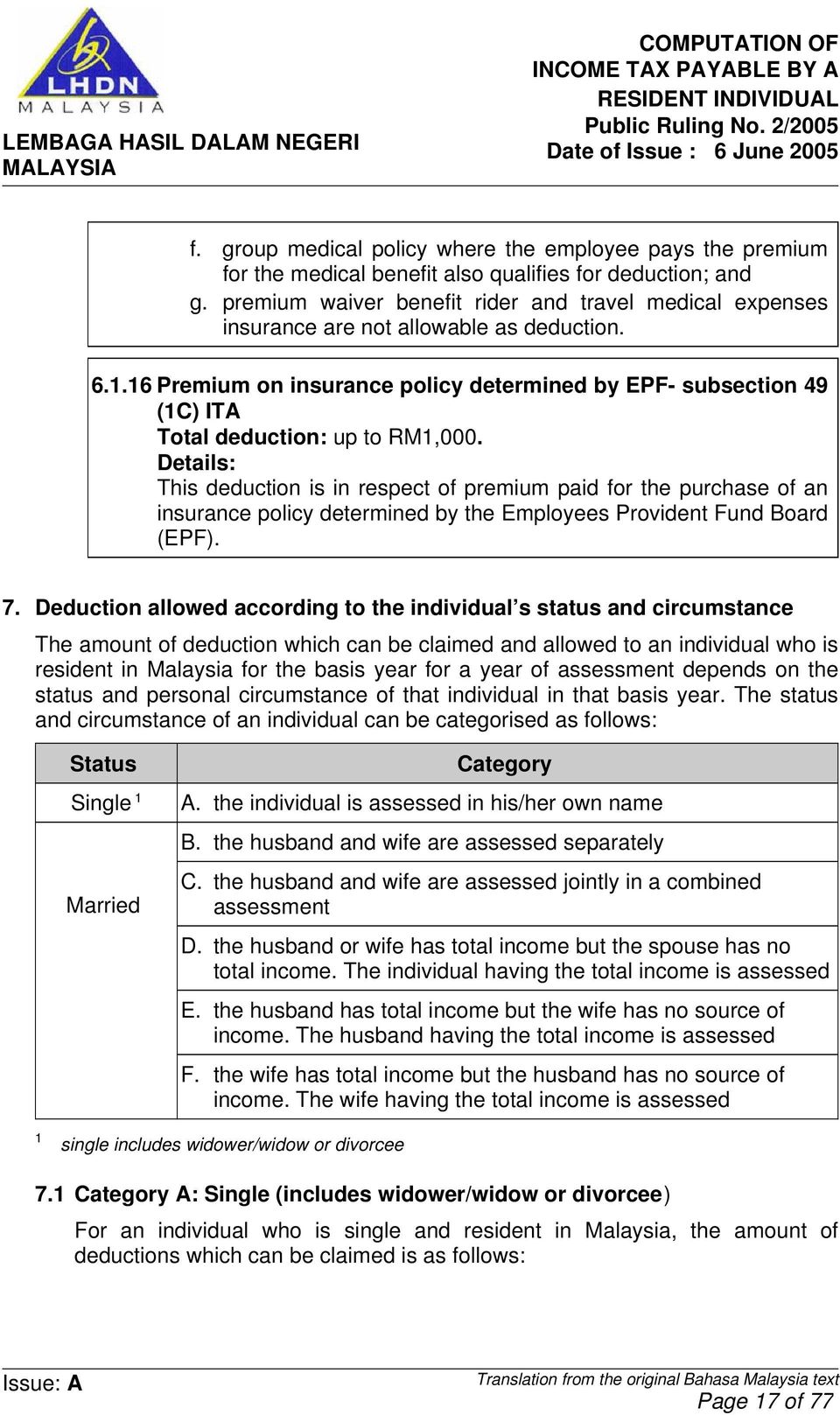

The objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and b the method of ascertaining the value of bik in order to determine the amount to be taken as gross income from employment of an employee.

Benefit in kind public ruling. Perquisites are taxable under paragraph. The objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and b the method of ascertaining the value of bik in order to determine the amount to be taken as gross income from employment of an employee. Benefits in kind bik generally non cash benefits e g. Pages 31 of 31.

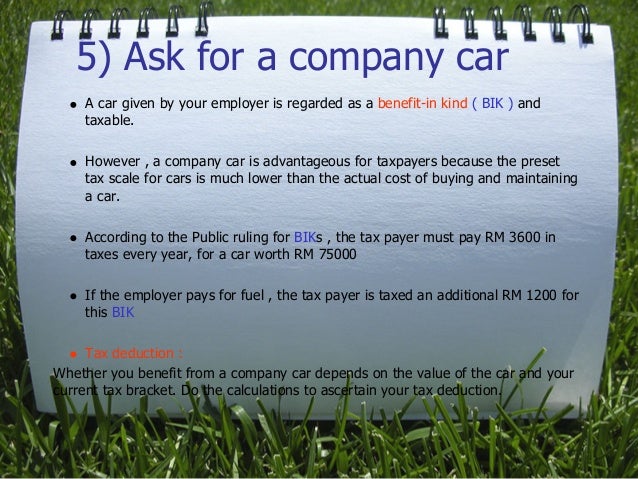

19 november 2019 4 2 perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment. 3 2013 date of issue. The benefit that is taxable is the total value of petrol provided to the employee and is chargeable to tax as part of gross income from employment under paragraph 13 1 b of the ita. Paragraph 6 1 4 of the public ruling no.

28 february 2013 pages 4 of 35 5 4. 2 2004 states that if an employee enjoys the benefit of a motorcar with free petrol the value of benefit on petrol to be included as part of gross income from employment will depend on the method used to value the benefit on motorcar. Inland revenue board of malaysia perquisites from employment public ruling no. 2 2013 date of issue.

There are several tax rules governing how these benefits are valued and reported for tax purposes. 2 gardener rm3 600 per gardener 3 household servant rm4 800 per servant 4 recreational club membership a indiviudal membership membership subscription paid or reimbursed by employer. Benefits in kind dated 15 march 2013. 5 2019 inland revenue board of malaysia date of publication.

The tax treatment on bik is explained in detail in the public ruling no.