Benefit In Kind Motor Vehicles Malaysia 2018

So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit.

Benefit in kind motor vehicles malaysia 2018. Inland revenue board of malaysia benefits in kind public ruling no. Benefits in kind biks are benefits provided to the employee by or on behalf of the employer that cannot be converted into money. 3 4 motorcar means a motor vehicle other than a motor vehicle licensed by the. June 2018 is the fy ending 30 june 2018.

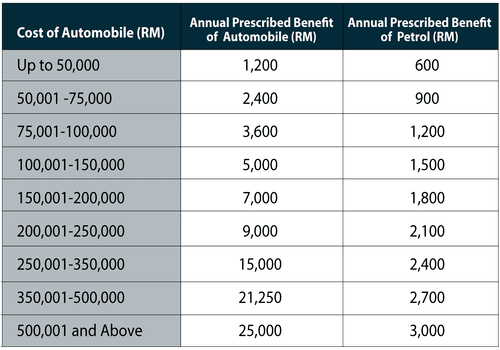

The cost of the motorcar is rm81 000. So how to determine the value to be added to the payroll. One overseas leave passage up to a maximum of rm3 000 for fares only. When taxable biks must be added to the payroll so they can be included in the pcb calculation.

The annual value of bik in respect of the motorcar which is taxable as. Motor cars provided by employers are taxable benefit in kind. These benefits are called benefits in kind bik. Employers goods provided free or at a discount.

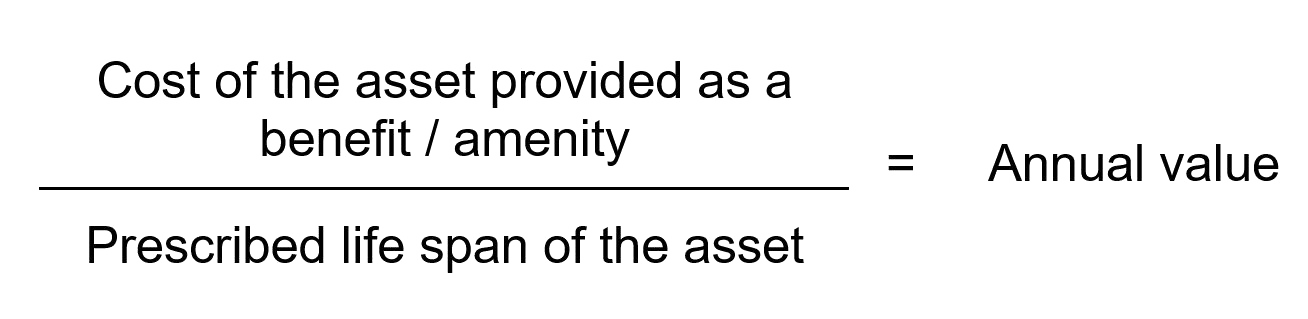

2 2004 issued on 8 november 2004. All income of persons other than a company limited liability partnership co operative or trust body are assessed on a calendar year basis. 3 2013 inland revenue board of malaysia date of issue. Motor vehicles and heavy machinery 20 20 office equipment furniture and fittings 20 10 agriculture allowance.

Benefits in kind public ruling no. Perquisites means benefits that are convertible into money received by an. And one should also be awar. Exemption is available up to rm1 000 per annum.

She is a renowned composer. Motorcar means a motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers. Malaysia adopts a self assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. Value of benefits in kind car and fuel scale.

A further clarification on benefits in kind in the form of goods and services offered at discounted prices. 3 local leave passages including fares meals and accommodation. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. 6 candy a singaporean citizen is resident in malaysia for the year of assessment 2018.

To him throughout the year 2018. 3 2013 date of issue. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable.

Any benefit exceeding rm1 000 will be subject to tax. 15 march 2013 page 2 of 28 4 4. Generally non cash benefits e g.