Benefit In Kind Malaysia

15 march 2013 pages 1 of 31 1.

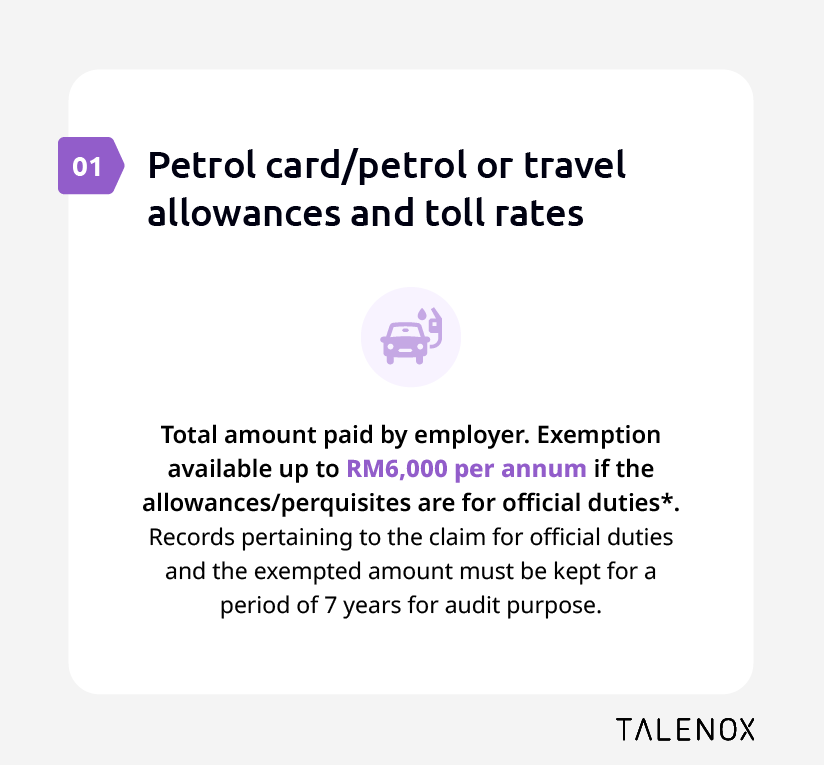

Benefit in kind malaysia. And in certain cases one should also be aware of the exemptions granted. Inland revenue board of malaysia benefits in kind public ruling no. Employers goods provided free or at a discount. When taxable biks must be added to the payroll so they can be included in the pcb calculation.

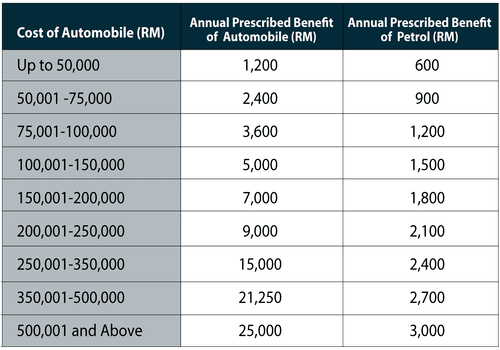

Car and related benefits provided to employees for private usage. Benefits in kind bik include several things such as. These benefits in kind are mentioned in. Inland revenue board of malaysia date of publication.

These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. Several tax rules are governing how those benefits are valued for tax purposes and income tax declaration. Inland revenue board of malaysia date of publication. So how to determine the value to be added to the payroll.

13 september 2018 page 1 of 36 1. One overseas leave passage up to a maximum of rm3 000 for fares only. Private treatment company car gym membership interest free loan travel expenses and living accommodation. Benefits in kind biks are benefits provided to the employee by or on behalf of the employer that cannot be converted into money.

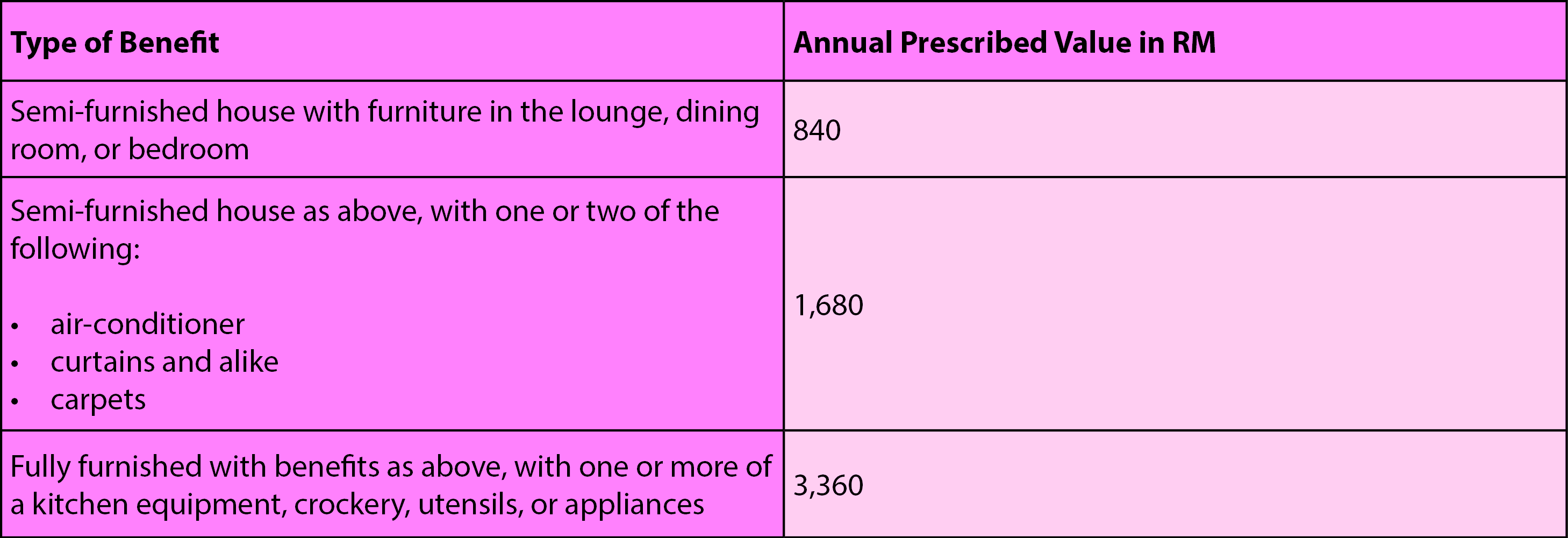

3 2013 date of issue. Residential accommodation provided to employees. Assets provided to employees for private usage phone furniture fittings household appliances etc. Tax exemption on benefits in kind received by an employee 2 1 benefits in kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from employment under paragraph 13 1 b of the income tax act 1967 ita.

11 2019 date of publication. Perquisites are taxable under paragraph. 3 local leave passages including fares meals and accommodation. Inland revenue board of malaysia benefits in kind public ruling no.

Benefits in kind are benefits provided by or on behalf of your employer that cannot be converted into money. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Benefits in kind or value of living accomodation that is given or provided. 12 december 2019 page 1 of 27 1.

Exemption is available up to rm1 000 per annum. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Any benefit exceeding rm1 000 will be subject to tax. 19 november 2019 4 2 perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment.