Benefit In Kind Malaysia 2018 Car

For further information please refer to irbm website for the following pr.

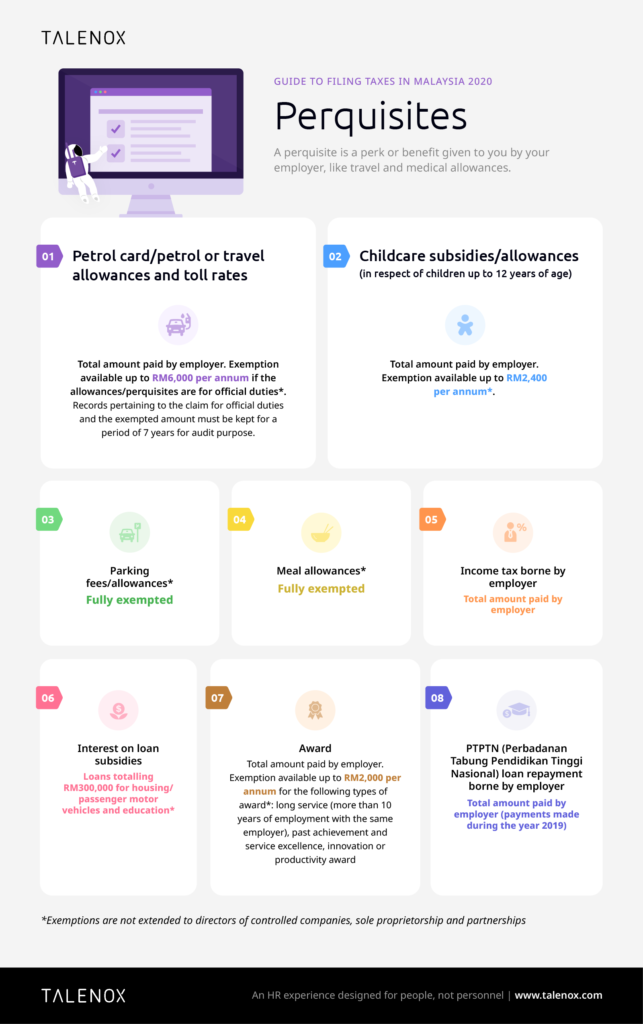

Benefit in kind malaysia 2018 car. Benefits in kind 2 5. Benefits in kind biks are benefits provided to the employee by or on behalf of the employer that cannot be converted into money. Inland revenue board of malaysia benefits in kind public ruling no. Inland revenue board of malaysia benefits in kind public ruling no.

These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. 7 2 the output tax in respect of benefits in kind perquisites or value of living accommodation received by an employee would only be taxable if the respective benefit in kind perquisite or value of living accommodation is taxable. 2 2004 issued on 8 november 2004. 3 2013 date of issue.

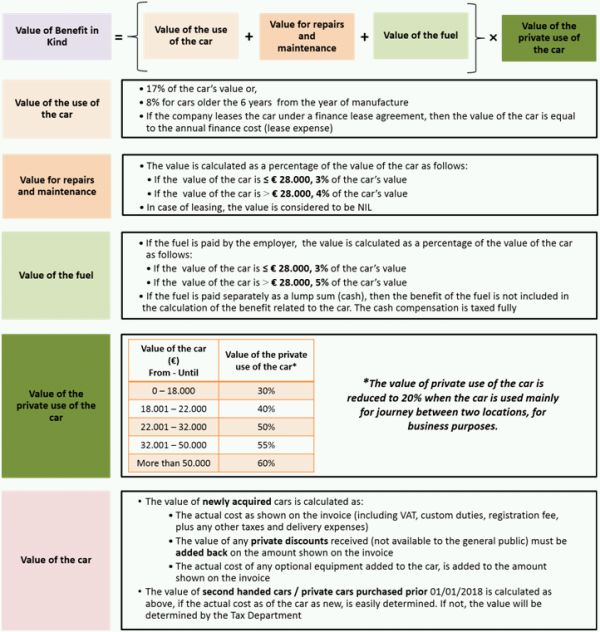

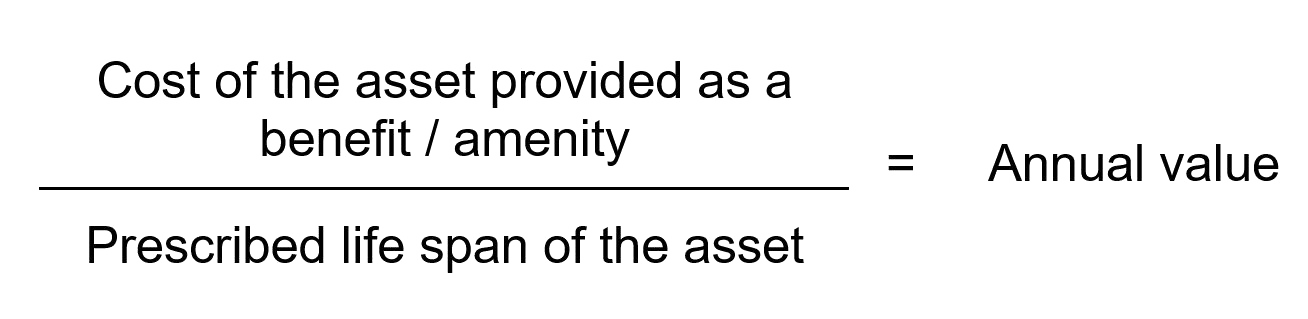

Ascertainment of the value of benefits in kind 3 6. Assets provided to employees for private usage phone furniture fittings household appliances etc. A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Where an employee has 2 or more cars made available at the same time see chapter 12 paragraph 12 37.

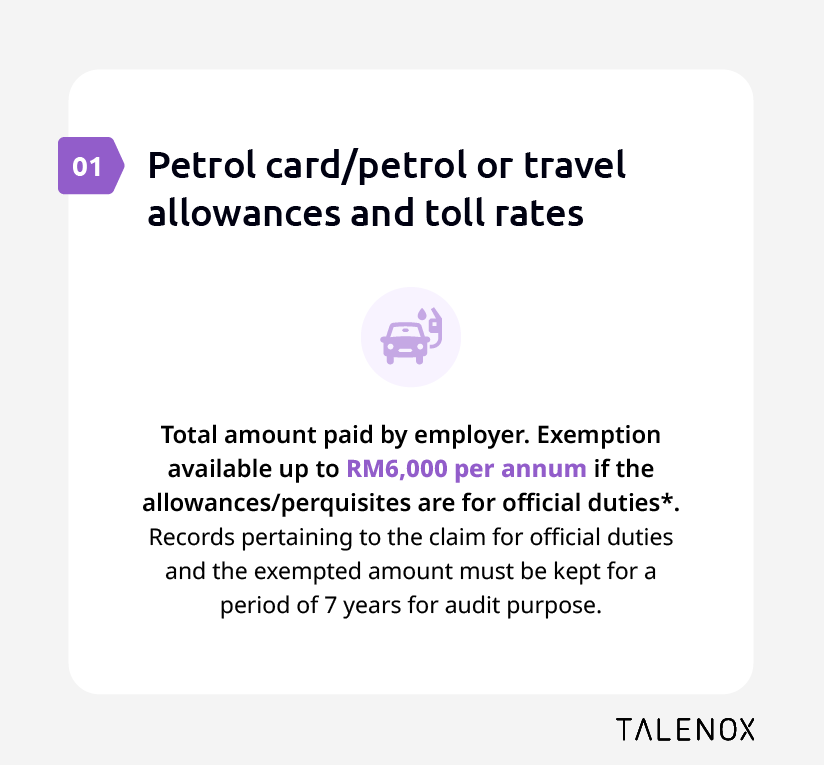

Petrol powered and hybrid powered cars for the tax year 2020 to 2021. Particulars of benefits in kind 4 7. June 2018 is the fy ending 30 june 2018. Malaysia adopts a self assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

11 2019 date of publication. A car which is provided to the employee is regarded to be used privately if. Motor cars provided by employers are taxable benefit in kind. When taxable biks must be added to the payroll so they can be included in the pcb calculation.

Residential accommodation provided to employees. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit. Car and related benefits provided to employees for private usage.

2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Relevant provisions of the law 1 3. 15 march 2013 pages 1 of 31 1. 12 december 2019 contents page 1.

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.