Benefit In Kind Malaysia 2016

Certain benefits in kind pertaining to consumable services are not eligible for taxation.

Benefit in kind malaysia 2016. 2 2004 issued on 8 november 2004. 3 2013 date of issue. They are sometimes called perks or fringe benefits. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no.

19 benefits in kind exemptions. All income of persons other than a company co operative or trust body are assessed on a calendar year basis. A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Inland revenue board of malaysia benefits in kind public ruling no.

It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure that are to be applied. Inland revenue board of malaysia benefits in kind public ruling no. 15 march 2013 pages 1 of 31 1. A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia.

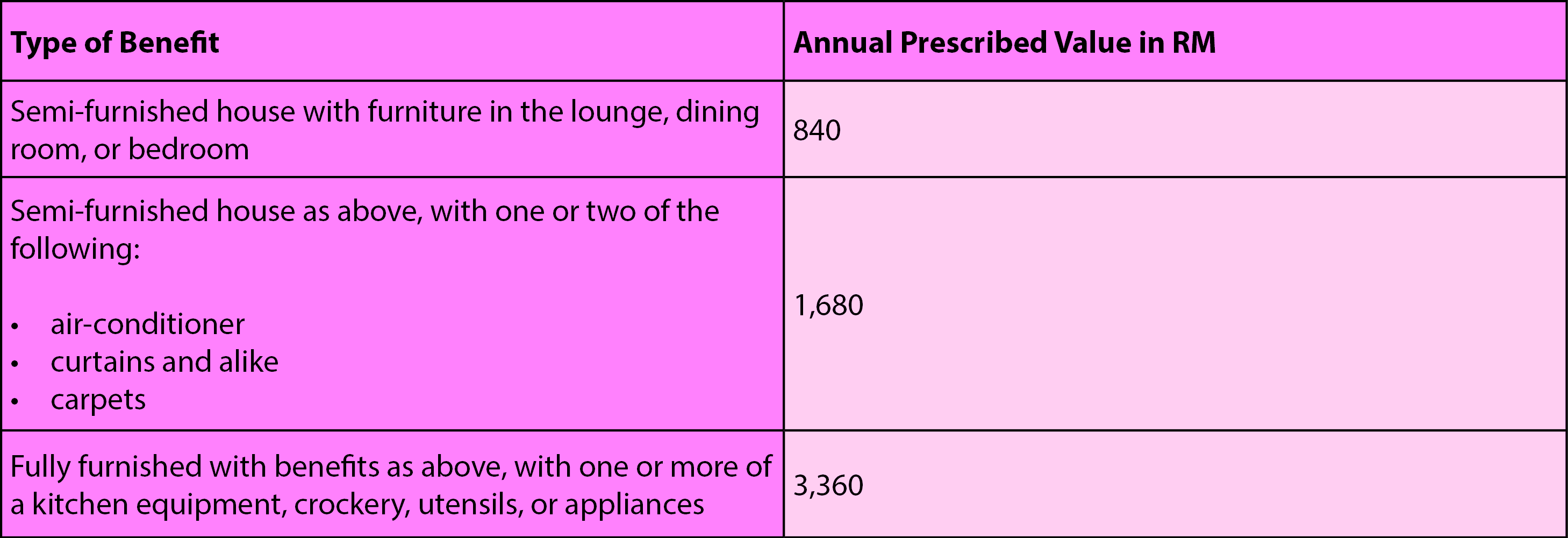

2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Since benefits in kind do not have a direct monetary value there are two ways to determine the value of a bik the formula. For example the basis period for the ya 2016 for a company which closes its accounts on 30 june 2016 is the financial year ending 30 june 2016. Benefits in kindare benefits which employees or directors receive from their employment but which are not included in their salary cheque or wages.

Malaysia adopts a self assessment system which means the responsibility to determine the correct tax liability lies. The ya 2016 for a company which closes its accounts on 30 june 2016 is the financial year ending 30 june 2016. 11 2019 date of publication. Malaysia income tax guide 2016.

12 december 2019 page 4 of 27 5 2 4 the value of bik based on the formula method provided to the employee by the employer can be abated if the bik is a provided for less than a year or and. They include things like company cars private medical insurance paid for by the employer and cheap or free loans. The definition of employment income covers all forms of remuneration including benefits whether in cash or in kind received by an individual for exercising or having an employment in malaysia 14 therefore an employee s income with respect to their employment in malaysia will be subject to malaysian tax regardless of whether it is paid in. Benefits in kind bik benefits in kind bik are taxable benefits that cannot be converted to cash and are given to an employee from his her employer.

Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc. 23 11 2016 refer year 2016.