Bank Study Loan Malaysia

Take note that most banks require a guarantor in order to be eligible for the loan listed below are some of the specific study loans offered by banks in malaysia.

Bank study loan malaysia. List of courses or programmes are subject to changes by maybank. The repayment period for most banks loans is about 10 to 15 years depending on the bank s terms and conditions. Here is how you can benefit from it. Duly completed study loan application and study loan checklist forms with all the required documents must be returned to the address stated below.

Bank rakyat is the biggest islamic cooperative bank in malaysia. A study loan is a loan product offered by a bank for the specific purpose of financing the borrower s education. Maju institute of educational development mied 1st floor menara manickavasagam no 1 jalan rahmat 50350 kuala lumpur. Mied offers study loans to underprivileged and needy students undertaking selected courses at mqa approved public or private heis in malaysia.

This is basically a loan in which the borrowers offer some of their assets for instance a car to act as a form of security or as a collateral for the loan. Bank negara malaysia offers scholarship programmes for malaysian students who wish to study at local or foreign universities. The rates stated above are based on a flat rate and vary according to the repayment period from 12 months onwards. The types of loan offered could either be secured or unsecured loans.

Bank rakyat study loan. Covers both local and overseas institutions including twinning programmes. Overseas courses require certification from jabatan perkhidmatan awam jpa. Pf 7 years is only applicable for financing amount rm11 000 and above only.

The university college or other education institution must be acceptable to the bank. Mied requires two guarantors. There are three scheme available. The guarantors should be.

Helps to cover any shortfall of your existing study funds up to rm250 000. The study loan offered by bank rakyat is called education financing i falah and it finances up to rm200 000 for a maximum loan. Mied offers a maximum of rm50 000 study loans to recognized universities in the public higher education institutions ipta private higher education institutions ipts and overseas or foreign universities recognized by jabatan perkhidmatan awam jpa. The study loan covers only part of the tuition fees which will be paid directly to the institutions.

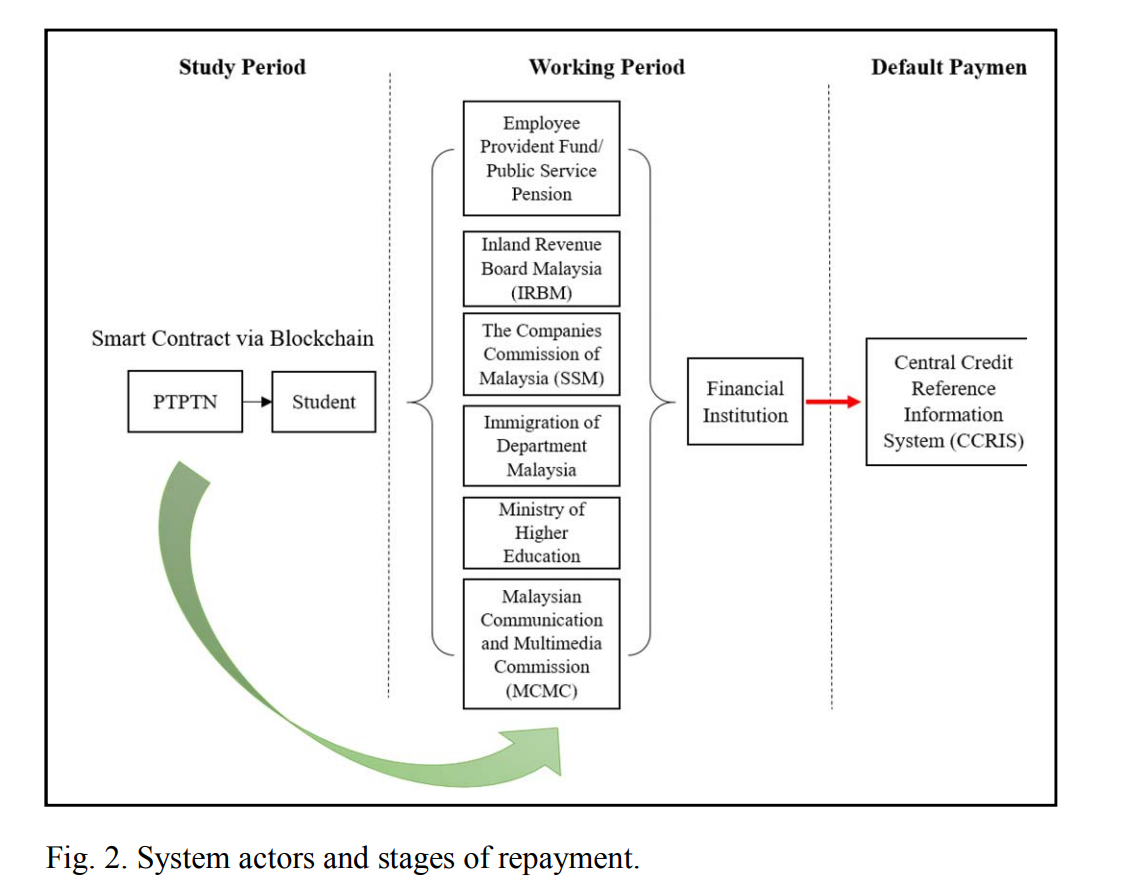

The ocbc education loan can help to supplement the funds that you have set aside for your child s higher education. In malaysia the national higher education fund ptptn is usually the first thing that comes to mind for those seeking education or study loans.