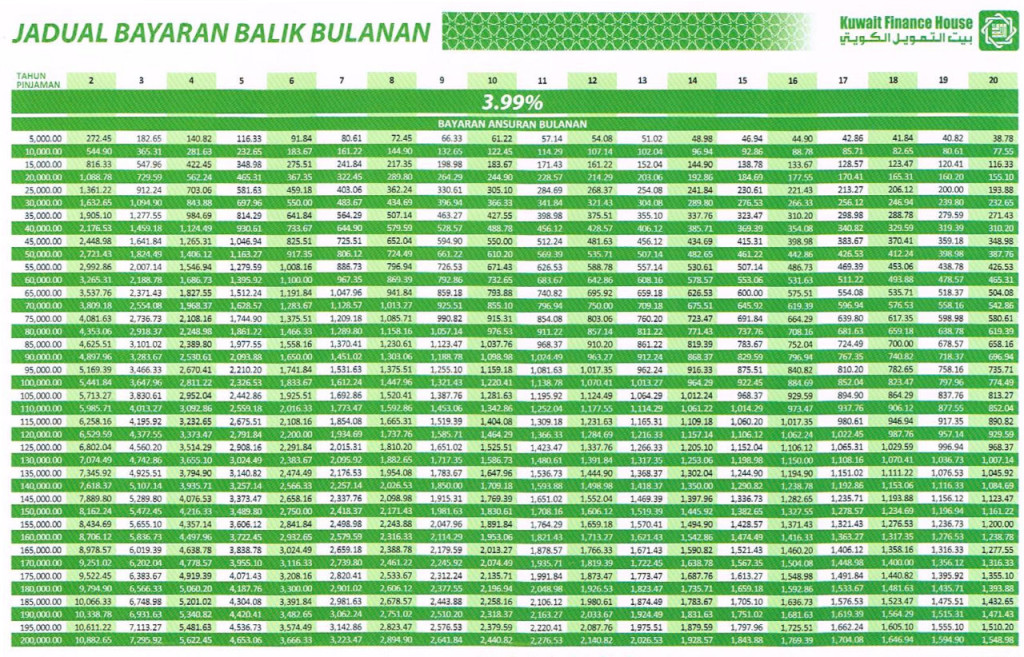

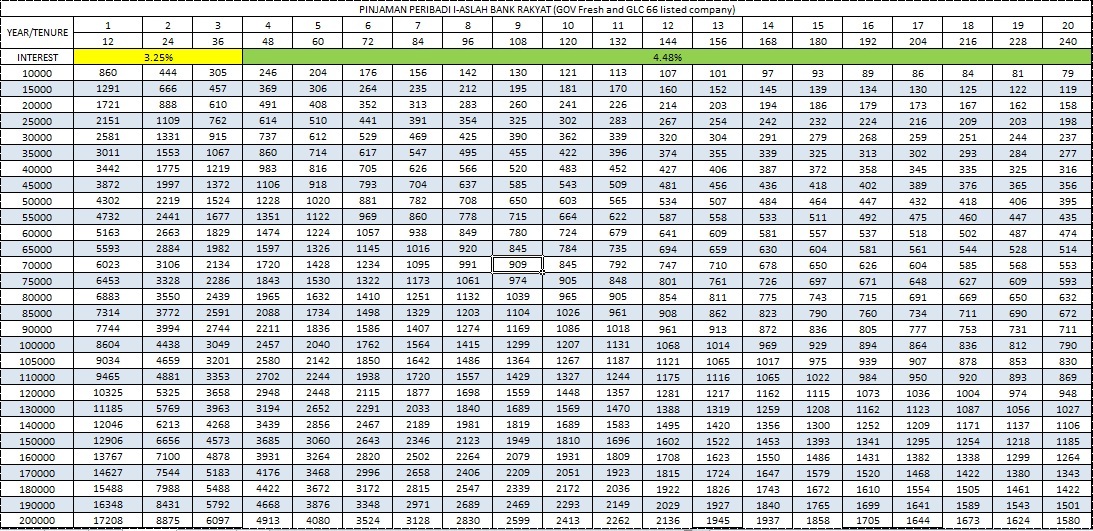

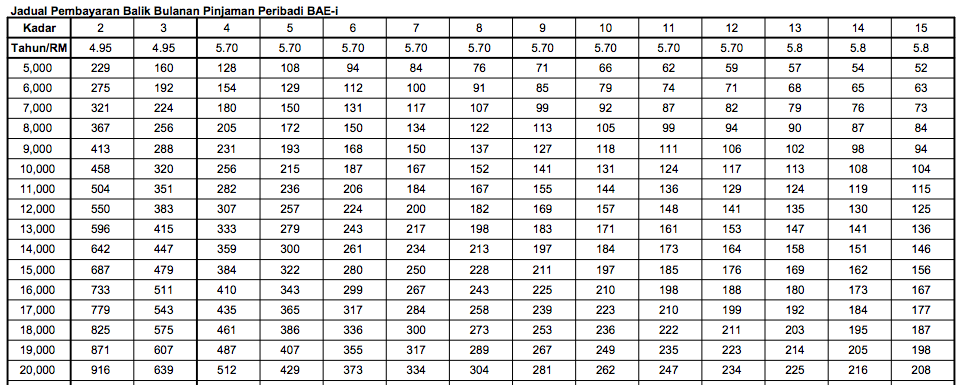

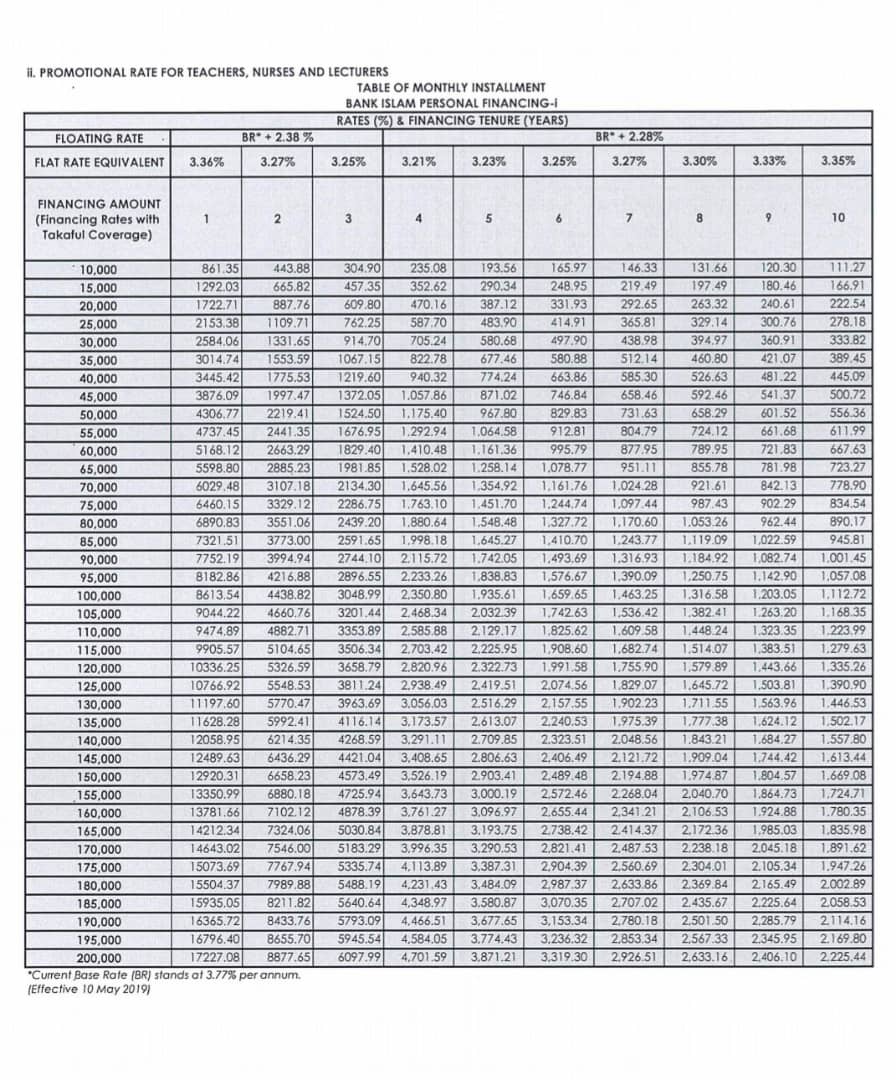

Bank Islam Personal Loan Table

Options of fixed or floating interest rates and takaful coverage.

Bank islam personal loan table. The special of this bank islam personal financing i facility is it is applied with syariah concept tawarruq. The loan table up to 10 years and rm100 000. Personal financing for professional program. Form programs for bank islam card i.

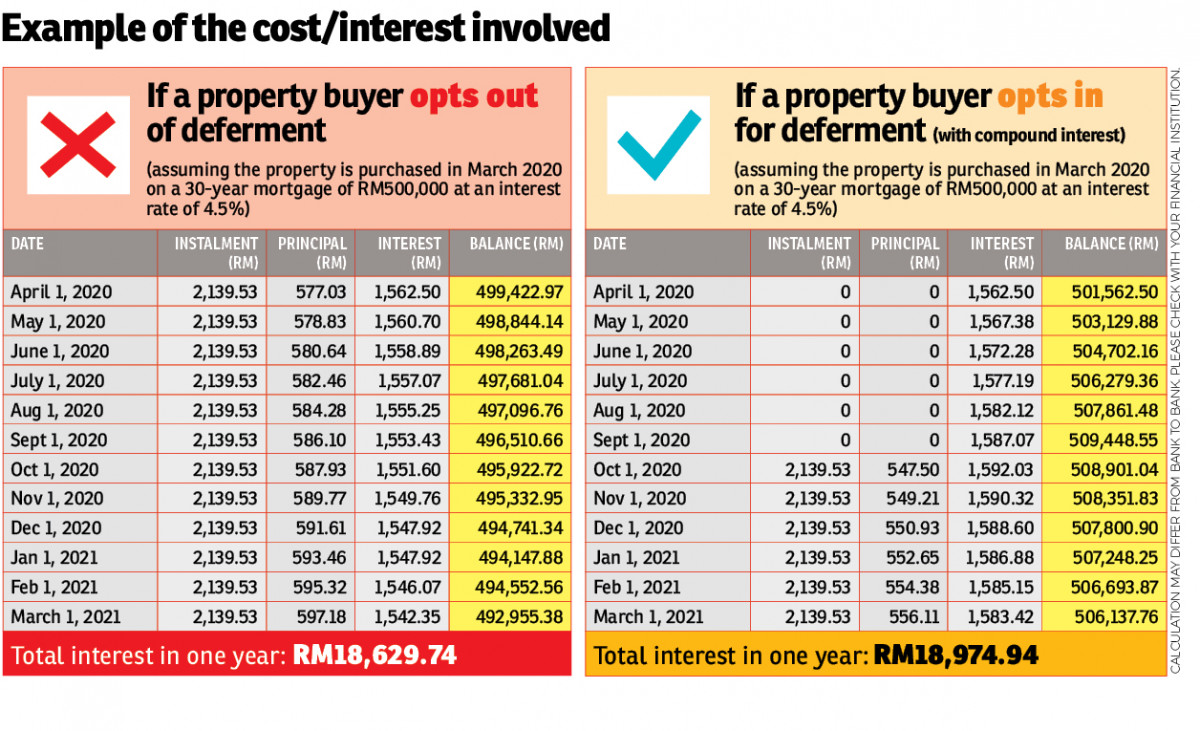

Revised br effective date 10 july 2020 is 2 52 p a. As of personal loans in malaysia there are no collateral nor guarantor is needed for the loan. 3 77 effective 12 05 2020 without takaful br 1 50. Bank islam was established in 1983 to address the financial needs of malaysia s muslim.

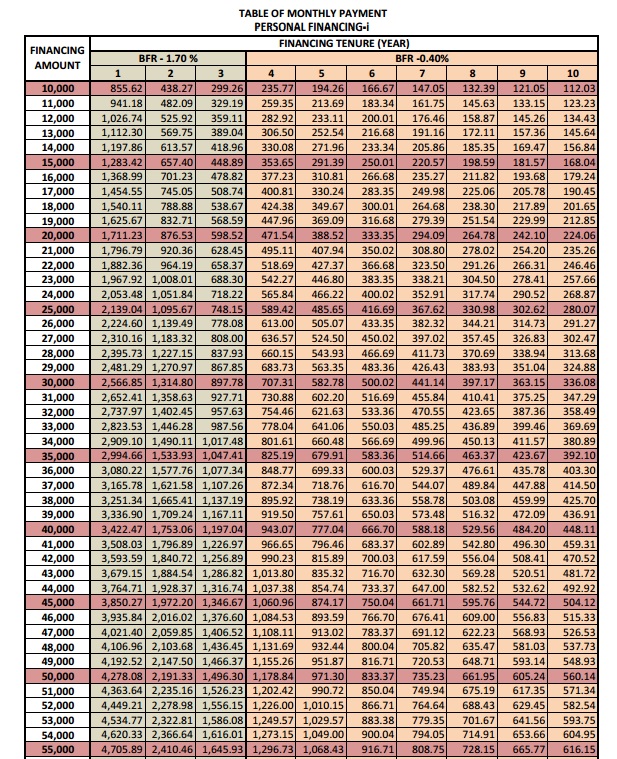

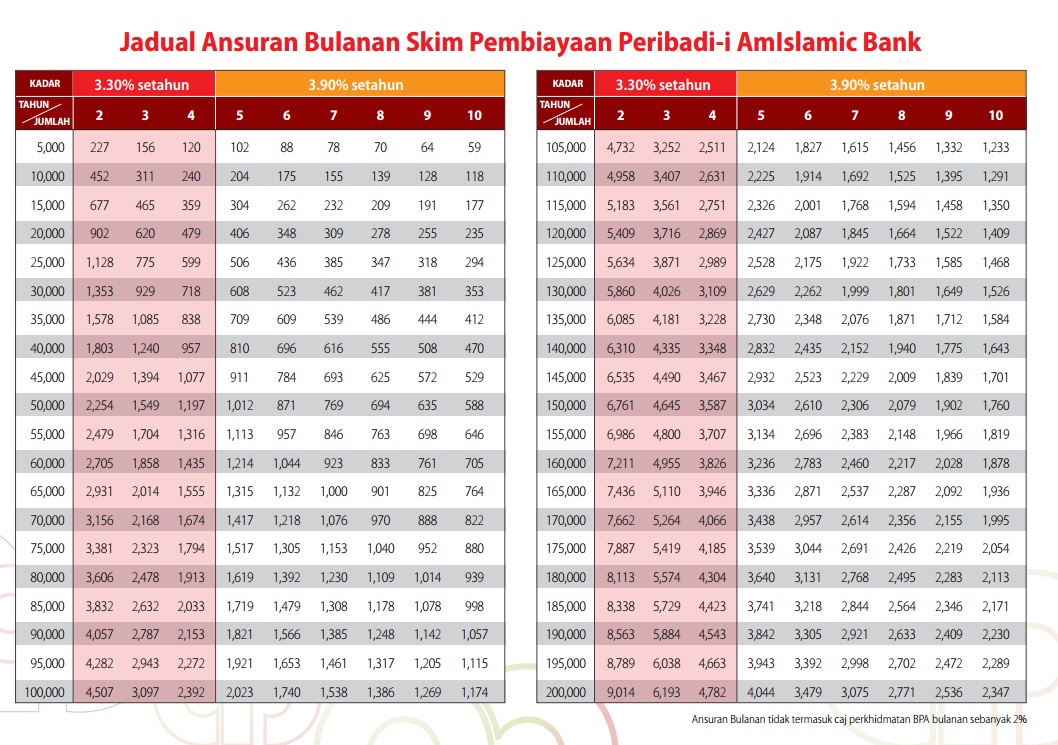

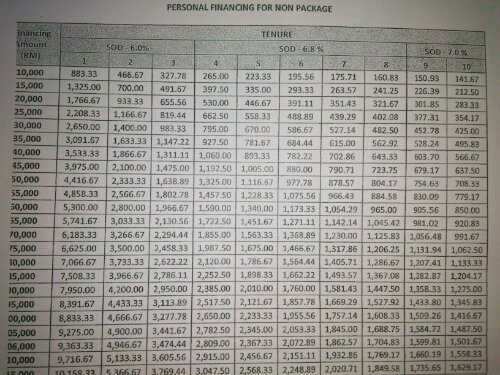

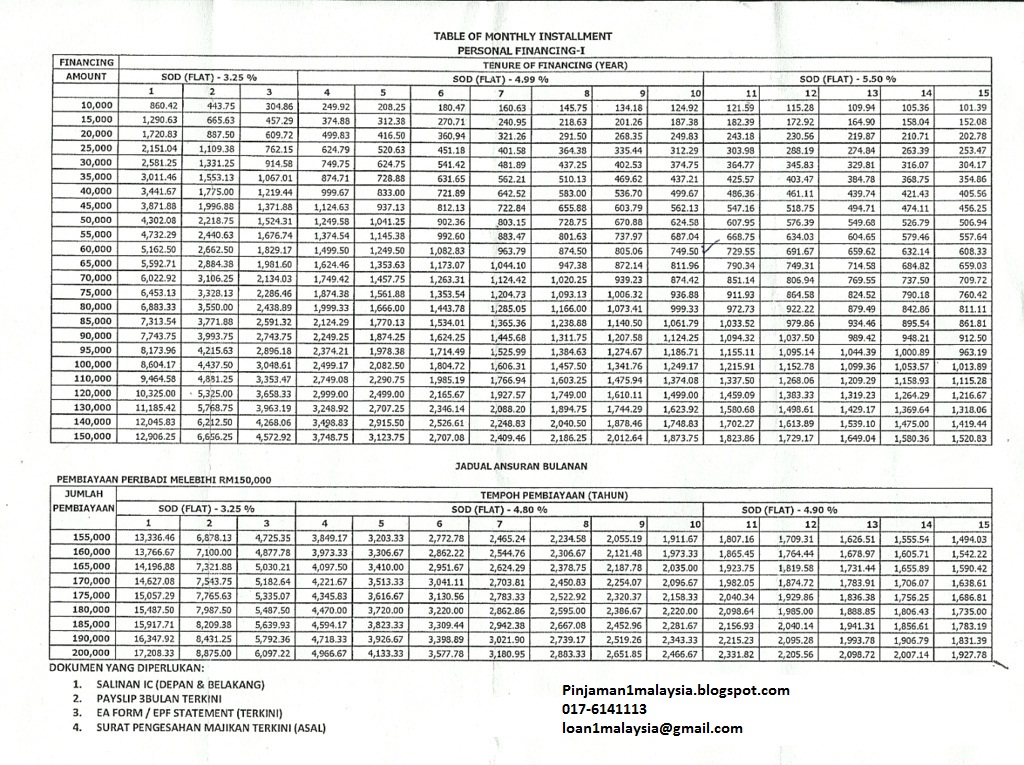

This is the payment table for personal loan provided by bank islam. Bank islam malaysia berhad jawi. Bank islam personal loan known as personal financing i facility. Bank islam credit card i.

It can be calculated as fixed rate or floating rate. Notice to bank islam customer retail payment platform services downtime notification integrated annual report 2019 is now available. Personal financing i non package. Applicants can even loan more than rm 200 000 if they provide collateral as security to bank islam.

Posts tagged with bank islam personal loan repayment table bank islam personal loan. Guarantor rights and obligations. With takaful br 1 00. Half year result ended 30 june 2020.

The amount of loan available is from rm 10 000 to rm 200 000. Bank islam debit card i. List of campaign winners. Bank islam was established primarily to assist the financial needs of the country s muslim population and extended its services to the broader population.

Lowest monthly payment in rm is stated there. The loan amount would be subjected to criteria such as monthly income and credit score. Guide for consumer on reference rate. Floating rate offer.

Introduction to bank islam malaysia berhad bimb personal loan financing. بڠك اسلام مليسيا برحد is an islamic bank based in malaysia that has been in operation since july 1983. It has made long strides to become a global leader in islamic banking and in upholding its status as the symbol of islamic banking in malaysia. It provide secured or unsecured term financing to meet customer financial needs.

Current interest rate is quite high around 6 per year and the minimum requirement to apply personal loan now is minimum salary rm2500 per month. Posted on september 11 2019 by admin. Guide for consumer on. Bank islam is the pioneer of shariah based banking in malaysia and south east asia.