Bank Islam Hire Purchase

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Bank islam can finance up to 90 of the car s price and is willing to give you a maximum period of nine years to pay off the loan amount.

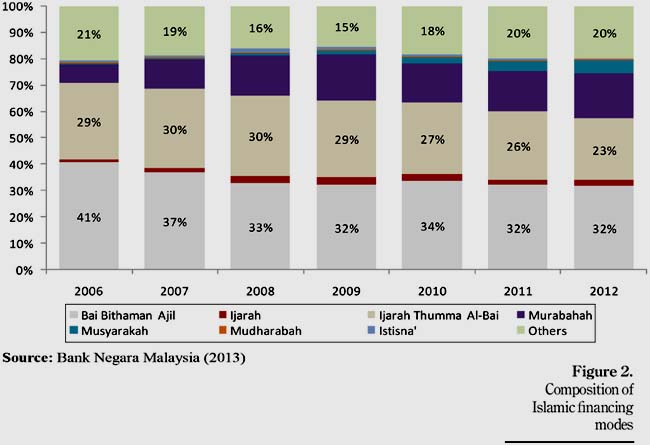

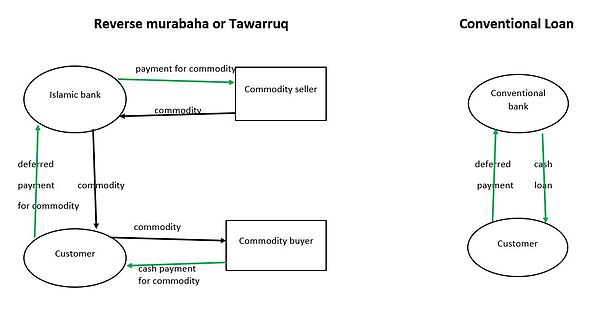

Bank islam hire purchase. The bank islam vehicle financing i is based on islamic concept of murabahah i e. Differences of hire purchase in conventional and islamic perspective commercial law law 3512. Margin of financing up to 90 of the otr price for national non national and unregistered reconditioned models. No bank current savings credit card loan financing hire purchase 1 affin bank 12 digits 12 digits 16 digits 12 digits 12 digits affin islamic bank 12 digits 12 digits 12 digits 12 digits 2 agrobank 16 digits 17 digits 3 alliance bank 15 digits 15 digits 16 digits 15 digits 15 digits.

Over rm15 000 000 worth of prizes to be won. In addition the bank reserves the right to perform further credit and or financing verification on you after the bank s approval of your auto financing and thereafter revoke the letter of undertaking issued to the dealer within 5 working. Method of sale with deferred payment. Empowering community beyond business.

Application forms and installment plans. Cimb islamic hire purchase i offers fast approval high margin of financing and flexible payment plan. Bank islam will never request for internet banking account updating via e mail or disclosure of customers personal identification number login id password and i access code to third parties under any circumstance. Bank islam credit card i.

Bank islam debit card i. Report any suspicious activity at 03 26 900 900. Lot r 01 01 r 01 02 emira d kayangan seksyen 13 40100 shah alam selangor. Bank islam hire purchase car loan vehicle financing i from bank islam is based on bai bithaman ajil bba contract method of sale with deferred payment to ease your burden while owning your dream car.

Financing you and your business. Save more with our non compounding charges credit cards.