Bai Bithaman Ajil Home Financing

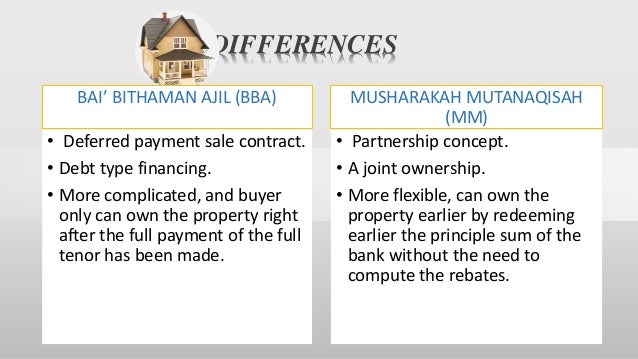

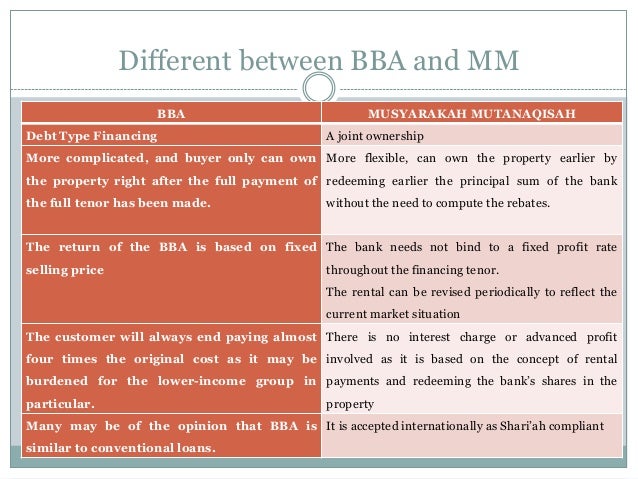

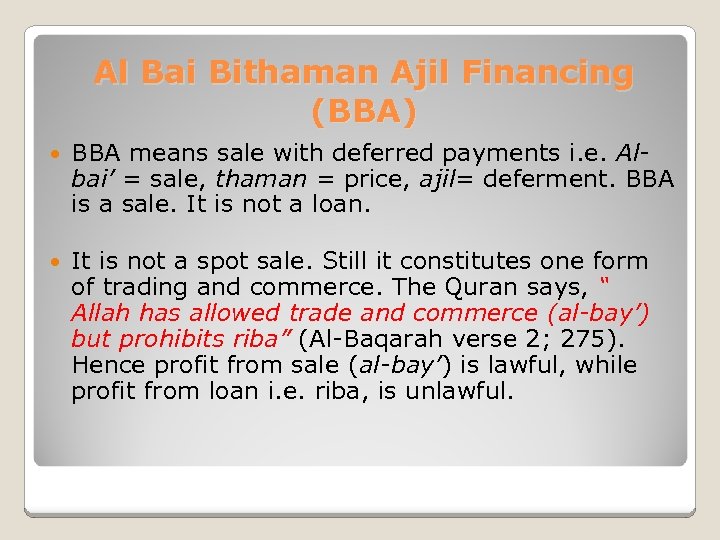

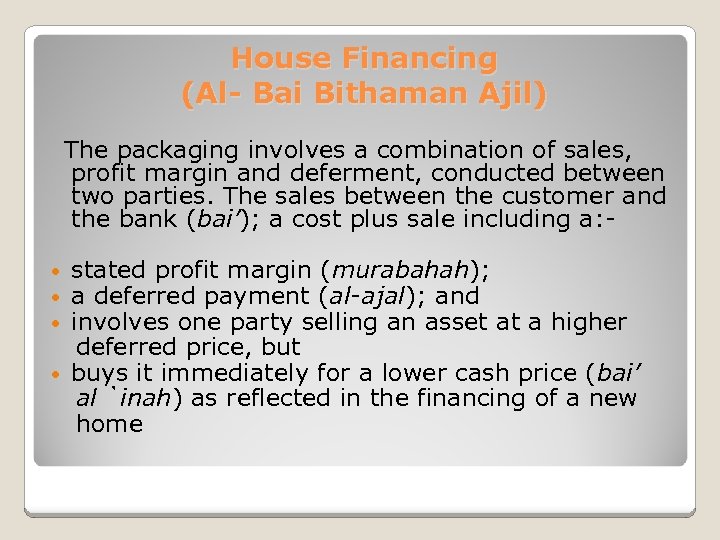

Bai bithaman ajil is one of the most popular islamic financing techniques used in malaysia and it can be considered as a substitute of the finance lease.

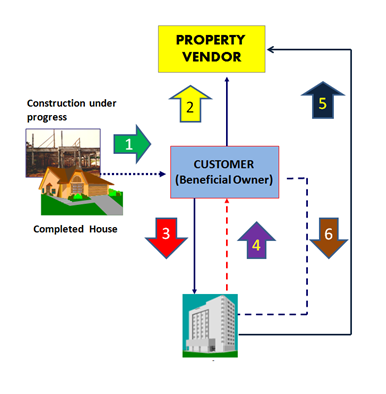

Bai bithaman ajil home financing. Refinancing from a conventional loan to islamic financing entitles customer to a full waiver on the stamp duty. Renovation extension of house. The current global financial crisis made some believe that the time has come for the islamic finance to assume a greater role. Islamic financial industry experienced an extraordinary growth over the last few decades and promises to grow even further.

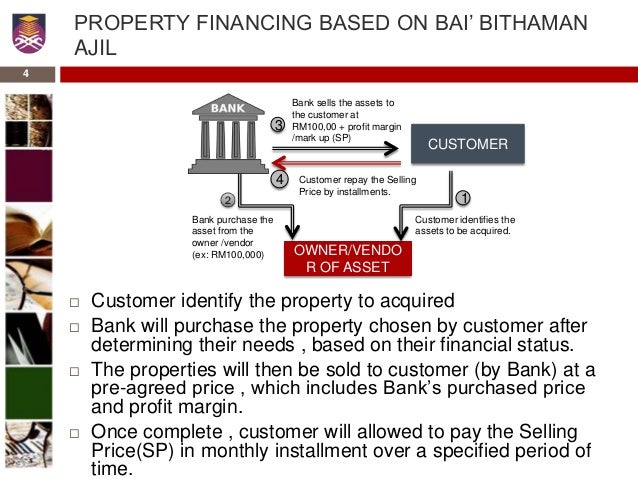

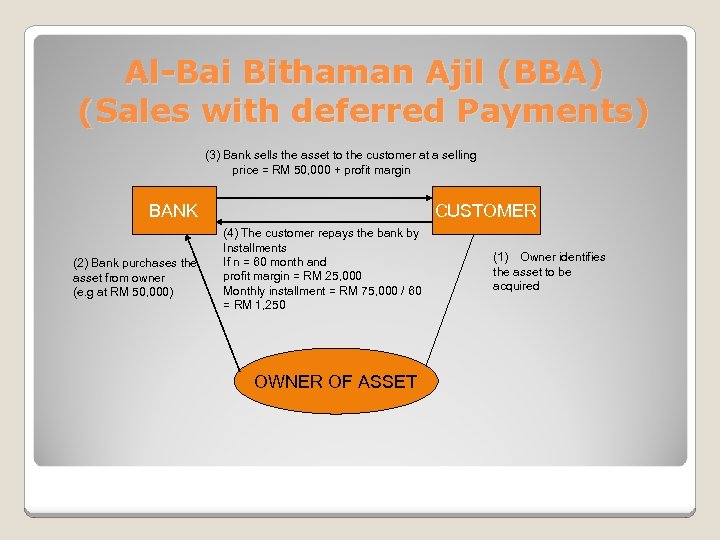

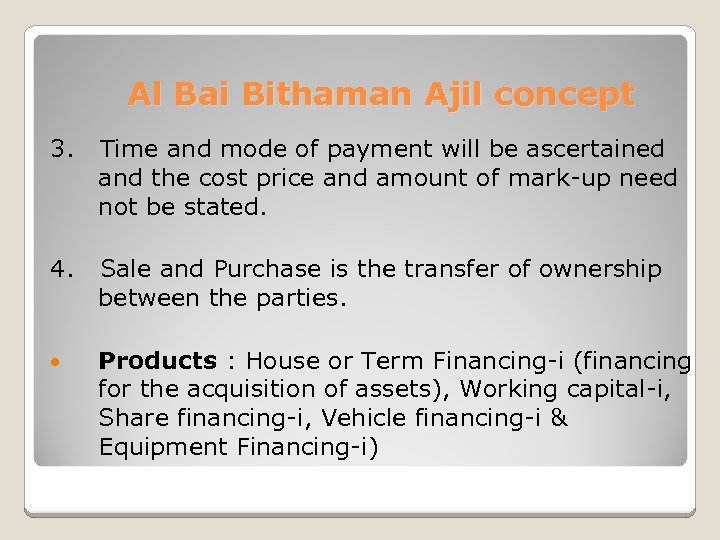

Based on the islamic principle of bai bithaman ajil bba variable rate financing allows you to finance your properties on monthly instalments that put your mind at ease and protect you from any increase in the base financing rate bfr beyond the ceiling rate. In analysing and evaluating on the application and compliance of islamic principles in al bai bithaman ajil home financing in malaysia reference will also be made to the cases referred to the. Variable rate financing is an alternative to the existing fixed rate financing. A completed home improvement financing application form.

Bai bithaman ajil bba usually bba is used for purchasing of properties home financing or commercial properties financing or sometimes for trade financing products. Rescheduling from other bank with an additional extension renovation of house. Original copy of applicant s latest three 3 months salary slips. Bai bithaman ajil bba purpose.

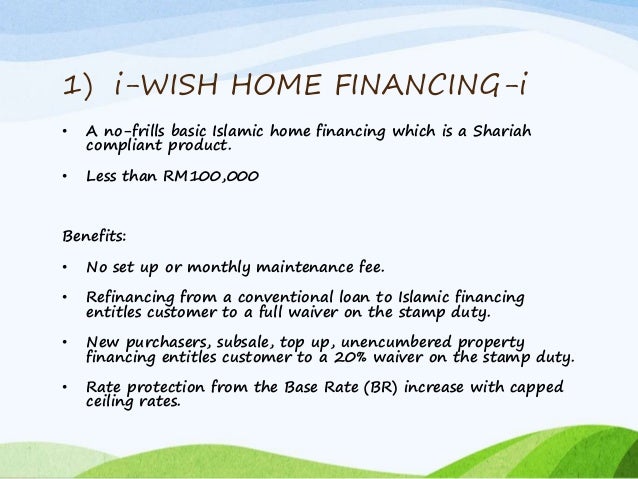

No set up or monthly maintenance fee. Identification card applicants and or home owner. It is used by customers to purchase assets of substantial value in installments from which they can generate future cash flows. Less than rm100 000 benefits.

The sale of goods on a deferred payment basis. 1 i wish home financing i a no frills basic islamic home financing which is a shariah compliant product. The dual banking system in malaysia is expected to put islamic banks at a disadvantage due to the latter s over dependency on fixed rate asset financing such as al bay bithaman ajil and murabahah when interest rates are rising rational product choice among non muslim customers nmc is expected to produce a shifting effect that may frustrate deposit mobilization and at the same time.