Annual Return Filing Fee Tax Deductible Malaysia

When do we submit annual return.

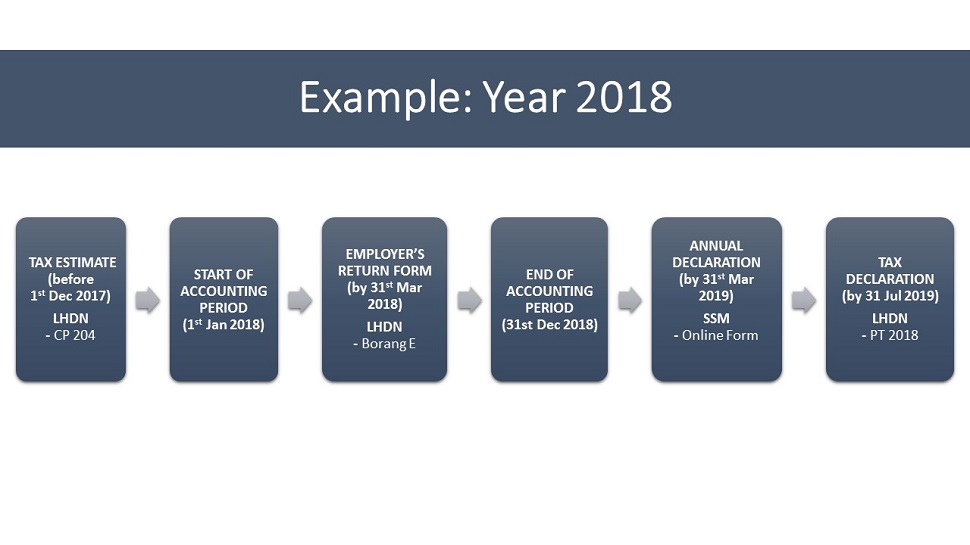

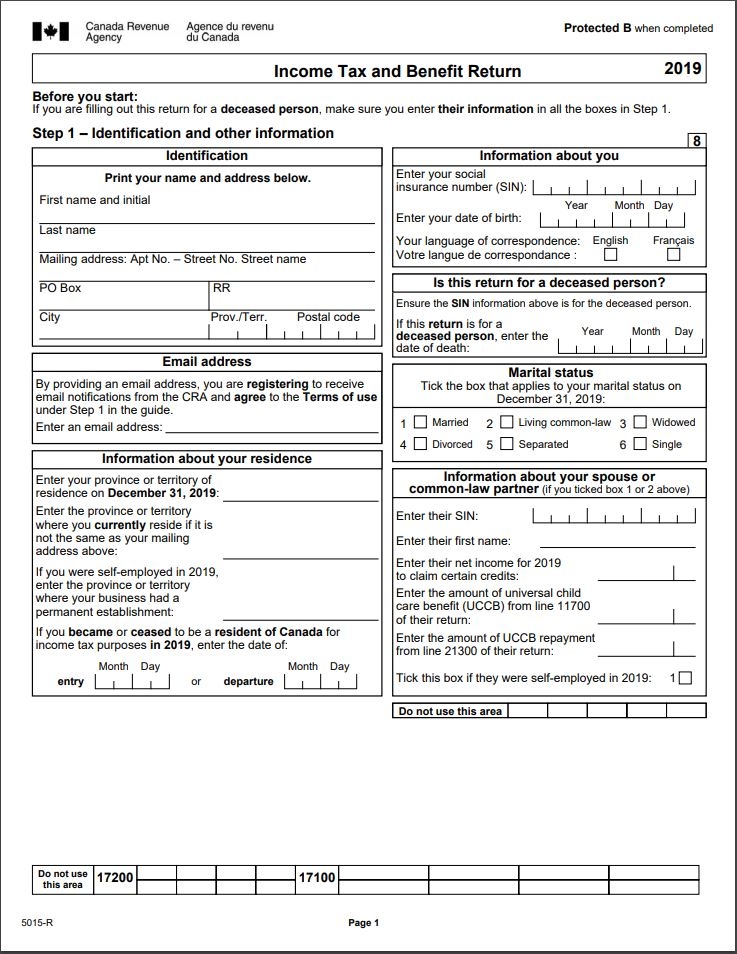

Annual return filing fee tax deductible malaysia. To submit the income tax return form by the due date. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. B annual general meeting expenses. What is tax rebate.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019. Keep all business records supporting documents for deductions reliefs and rebate for a period of 7 years. To the special commissioners of income tax and the courts. If your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged.

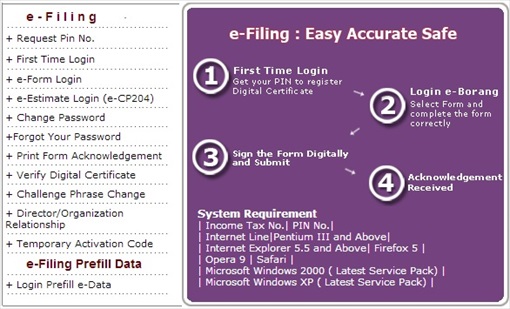

Malaysia income tax e filing. 6 5 legal expense incurred by a landlord. What is income tax return. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.

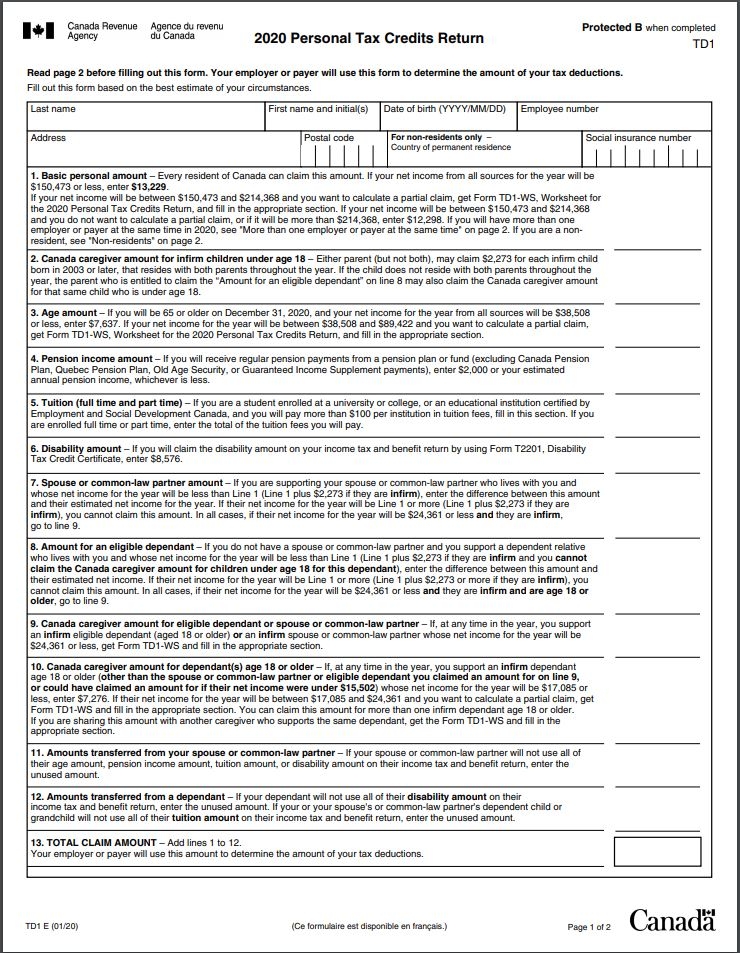

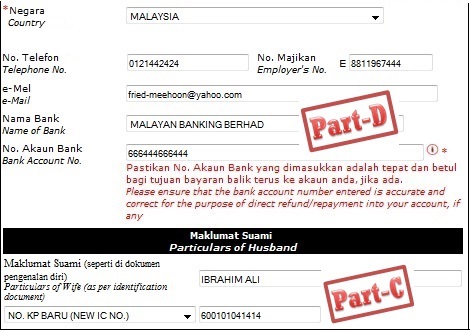

Because this is the most comprehensive and practical guide on income tax relief in malaysia for the non tax savvy you yes you. According to the new company act 2016 that in force on january 2017 companies are required to submit the annual return no later than 30 days from the anniversary of the company incorporation date. All supporting documents like business records cp30 and receipts need not be submitted with form p. Claiming of tax filing fees tax filing fees for tax estimates in respect of ya 2016 which are paid and incurred in the basis period for ya 2015 will be allowed a deductionin the ya 2015 as services have been rendered.

Tax filing fee tax filing fee charged by a tax agent approved under the ita or the goods and services gst act 2014 which is incurred and paid by the person in the basis period for that ya in respect of. B cost of appeal against income tax assessment i e. Then you have landed in the right page. The total amount of deduction allowed for secretarial fee shall not exceed rm5 000 for a ya.

Tax rebate for. 6 3 annual corporate filings and meeting expenses a secretarial fees. Filing for your tax for year of assessment 2019 but aren t sure if you are maximizing all your malaysian income tax relief. However the irb appears to take the position that the deduction allowed for tax filing fees under.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. A malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arm s length and the relevant whts where applicable have been deducted and remitted to the malaysian tax authorities. The submissions of annual returns of a company are mandatory and the most important legal requirement set by the ssm. 6 4 income tax returns a cost of filing of tax returns and tax computations.

Tax rebate for self. This is in line with paragraph 2 1 b ii of the rules. What is a tax deduction.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)