Aia Medical Card Takaful

Let s find out more.

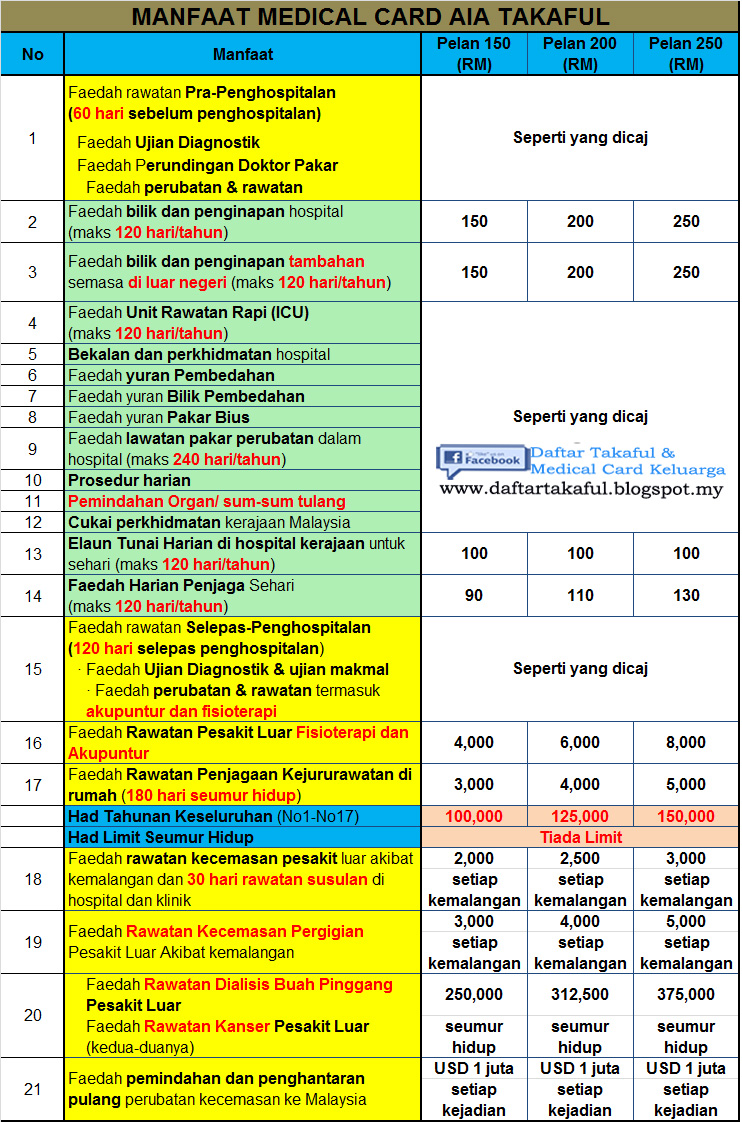

Aia medical card takaful. Kalau ditanya pada ejen takaful sah sah akan kata syarikat takaful dia yang terbaik. Medical card aia public takaful malaysia untuk keluarga fairuzramli isnin april 13 2015. Medical card aia takaful boleh diambil menerusi dua jenis pelan iaitu pelan stand alone di mana anda hanya akan mendapat manfaat kad perubatan sahaja dan pelan investment link di mana anda akan mendapat manfaat lain seperti pampasan kematian kemalangan dan sebagainya. If there is any excess from the takaful risk fund at the end of every year aia public will share it with the eligible participants at 50 50 ratio.

5 sebab utama usahawan perlu membuat hibah hartanah baca artikel. 201001040438 924363 w aia pension asset management sdn. 201101007816 935955 m aia general berhad. 200701032867 790895 d aia public takaful bhd.

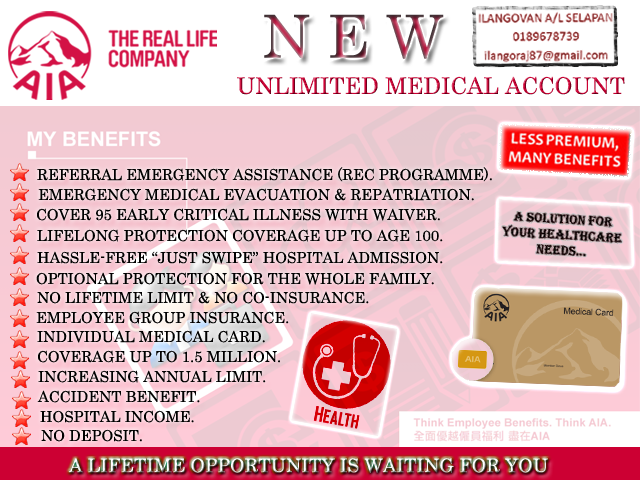

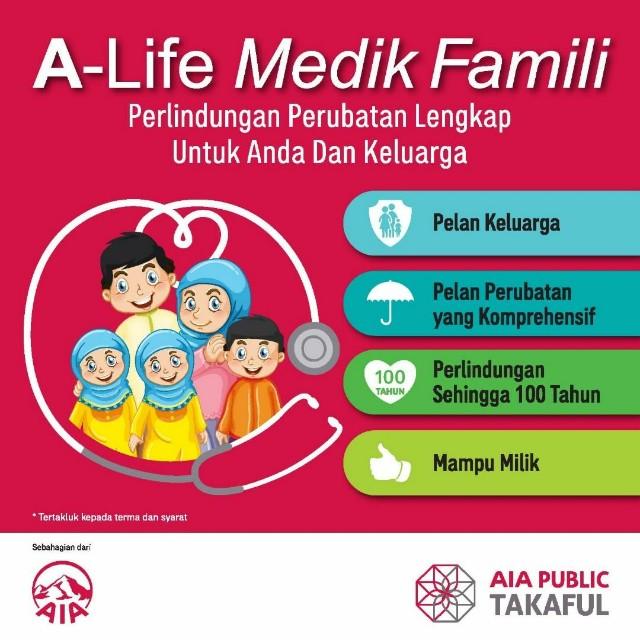

Jawapannya pelan medical card aia public takaful. Takaful lingo explained what does lifetime limit mean. A plus health i is a takaful medical plan that offers comprehensive hospitalisation benefits at the same time rewards you for staying healthy up to rm2 000 a year. Medical card keluarga aia public takaful malaysia.

Medical card yang patuh syariah seperti prubsn takaful aia public takaful great eastern takaful ammetlife takaful zurich takaful dan banyak lagi. Contact aia malaysia today. Maksima anak untuk pelan ini adalah 4 orang. This is because for the latter the benefits may not fit your needs and its coverage valid only during your employment with the company.

Medical card simpanan hibah kematian penyakit kritikal. Terdapat 2 jenis pelan untuk family iaitu medical card family standalone dan medical card family with investment recommended. Medical card keluarga takaful tanpa limit bagi setiap ahli keluarga. Pelan famili a life medik famili.

Anda wajib menyediakan pelan aia public takaful ini untuk setiap orang anak anda. Pelan ini boleh didapati dalam pelan famili dan pelan individu. Having a personal takaful medical card allows you to tailor your own coverage according to your requirements compared to relying solely on your company group term.