Age Limit For Epf Contribution

Pension contribution not to be paid.

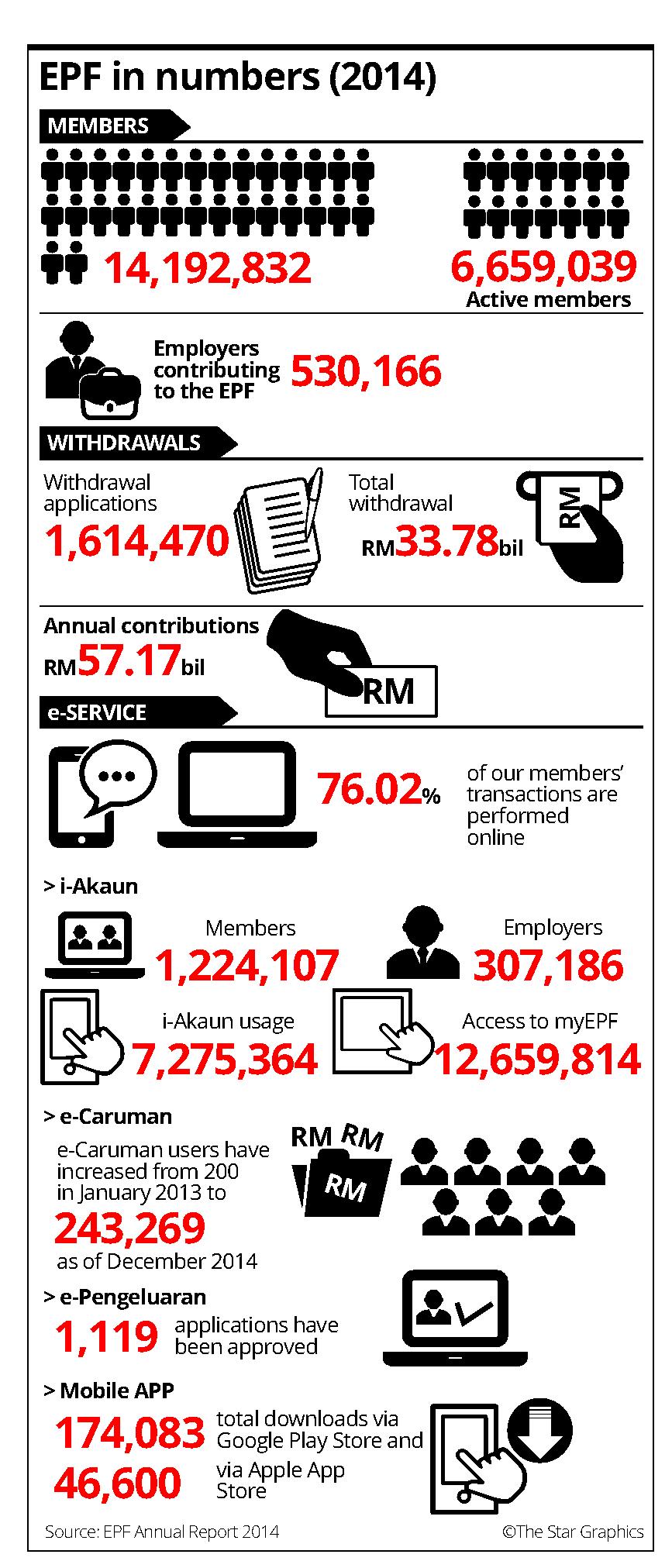

Age limit for epf contribution. The new minimum statutory rates proposed in budget 2019 are effective this month for the contribution month of february said epf. The minimum employers share of the employees provident fund epf statutory contribution rate for employees aged 60 and above has been reduced to 4 per month. When an eps pensioner is drawing reduced pension and re joins as an employee. Meanwhile the employees share of contribution for this age group is set at zero the epf said in a statement today.

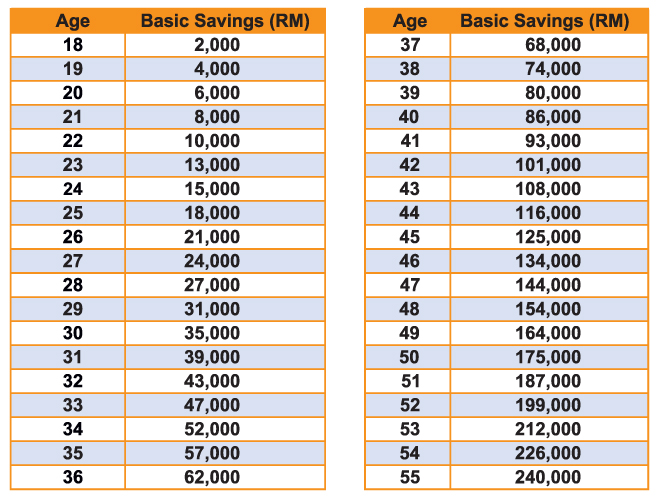

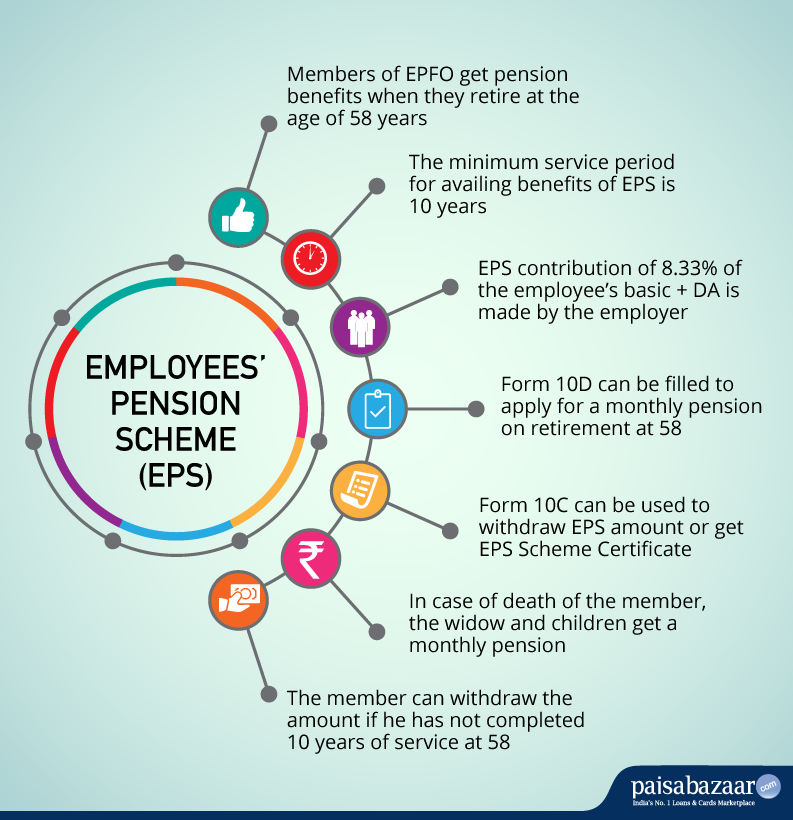

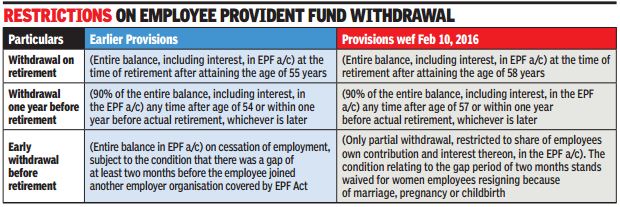

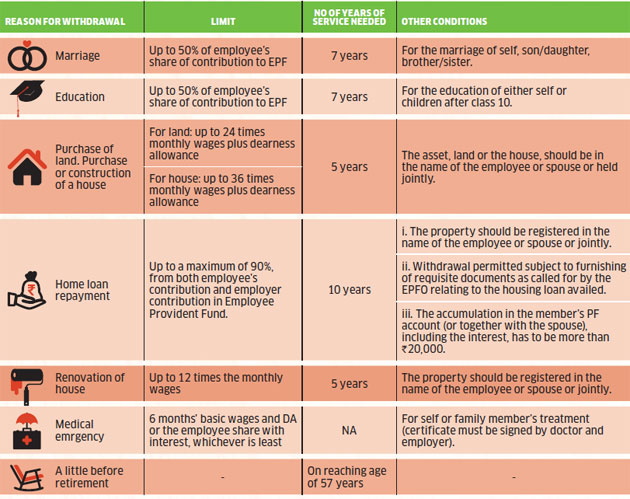

The total epf balance includes the employee s contribution and that of the employer along with the accrued interest. When an employee crosses 58 years of age and is in service eps membership ceases on completion of 58 years. Kuala lumpur jan 7. According to the epf act for claiming final epf settlement one has to retire from service after attaining 55 years of age.

Contribution is payable out of the employer s share of pf and no contribution is payable by employee. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Therefore being based on these changes and as in october 2015 the decisions made in the meeting has impacted in the following changes in the epf limits. 8 33 from the employer s share of provident fund contributions of the total salaries that is limited to rs.

Epfo trustees okay raising age limit under pension scheme to 60 at present a formal sector worker covered under the eps 95 can make contributions towards pension scheme till the age of 58 years. The age limit for epf contribution is 58 years old by the employer. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the contribution rate third schedule monthly contributions are made up of the employee s and employer s share which is paid by the employer through various methods available to them. However an employee can continue to contribute towards epf.

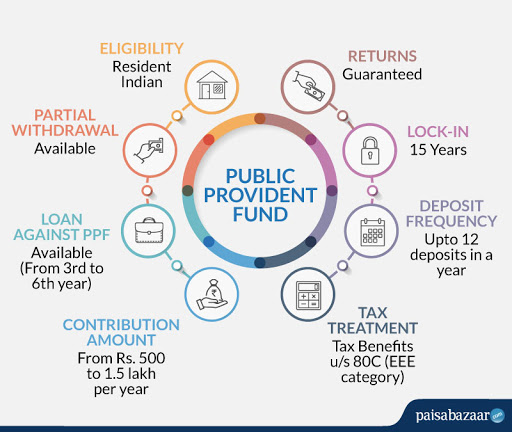

But for i saraan you need to inform epf that you wish to apply for i saraan so that you re entitled to the 15 matching incentive from our government maximum rm250.