Affin Bank Personal Loan Application

Protect life general vehicle insurance.

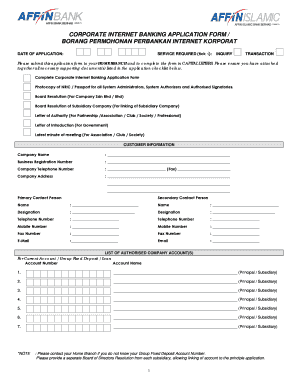

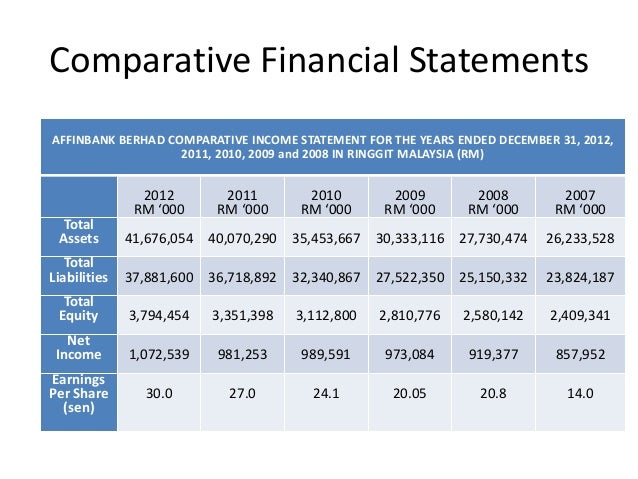

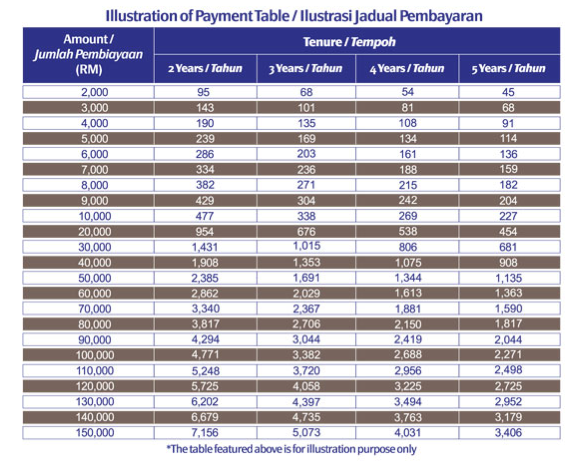

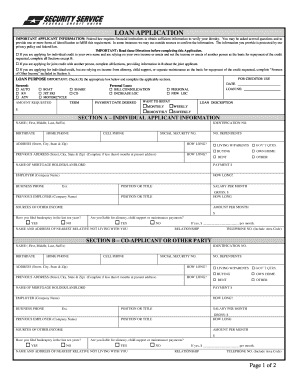

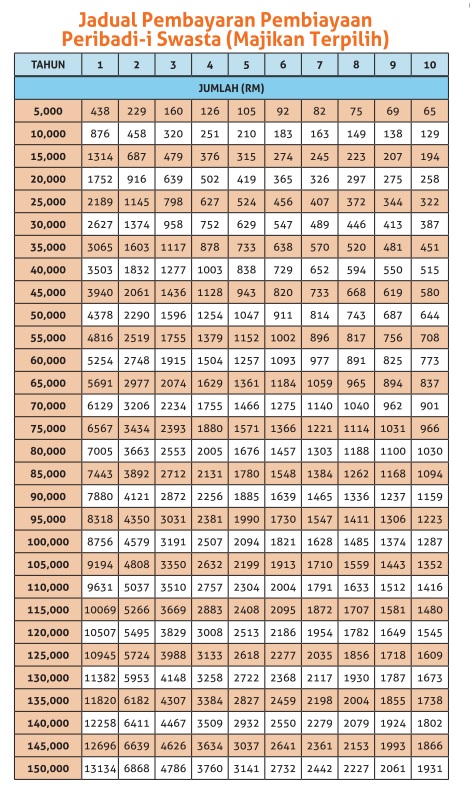

Affin bank personal loan application. Affin bank personal loan malaysia affin bank personal loan repayment table. Who can apply for this islamic personal loan. In addition the loan has no hidden charges or terms and doesn t need any collateral or guarantor. Affin islamic bank requires you to disclose the purpose of financing in the application form.

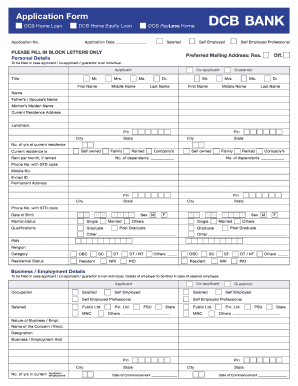

Financial products from the bank are strictly for applicants who have fills in the application form with an actual purpose particularly for personal consumption. Loan vehicle property loans. Loan vehicle property loans. Applicant with annual income of rm36 000 per annum or less is allowed to only hold credit cards from a maximum of two 2 banks or card issuers.

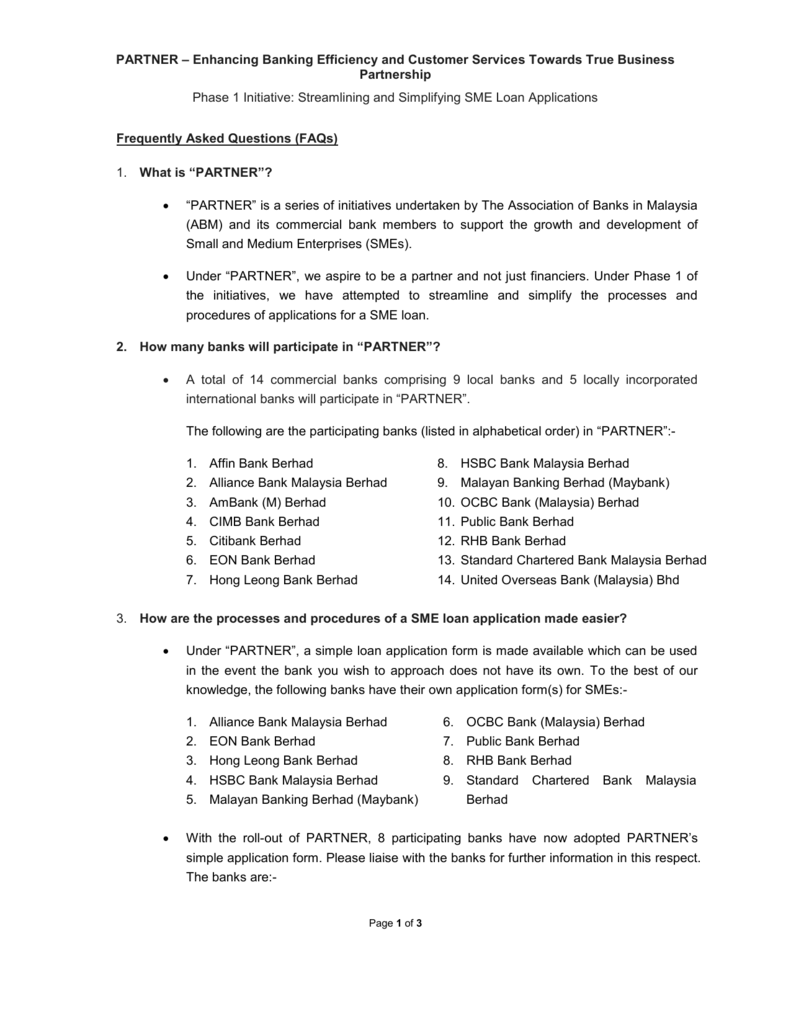

Fill in the form and send to. To expedite your loan application please fill up the following simple affinbank sme loan application form and forward to nearest affinbank business centre. Click here to download the application form. Affin duo application form general criteria for credit card application age eligibility.

Conversion of credit card outstanding balances into term loan term financing. 21 years old and above for principal cardmembers and 18 years old and above for supplementary cardmembers. Contact centre 03 8230 2222. If your repayment is prompt.

6 12 24 or 36 months. 03 july 2020 revision of loan financing payment due date. The minimum age eligible to apply for this islamic financing is 21 years old with the maximum age capped at 58 years old. Apply by following the below steps.

Invest unit trust asnb. Contact centre 03 8230 2222. Quick banking digital branch services. Protect life general vehicle insurance.