2019 Income Tax Relief Malaysia

The chargeable income is nil and no income tax is payable for that ya.

2019 income tax relief malaysia. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. What is income tax return. How to pay income. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. 1 tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019.

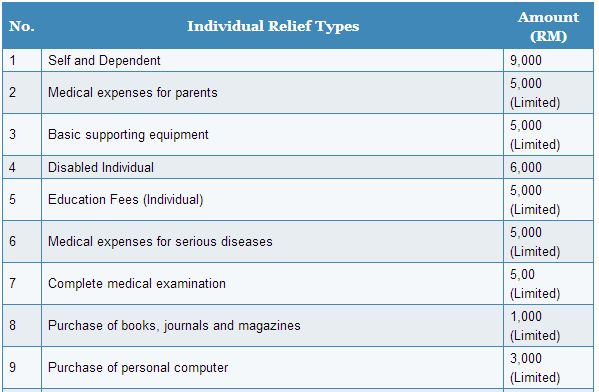

Amount rm 1. How does monthly tax deduction mtd pcb work in malaysia. Here are the income tax rates for personal income tax in malaysia for ya 2019. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

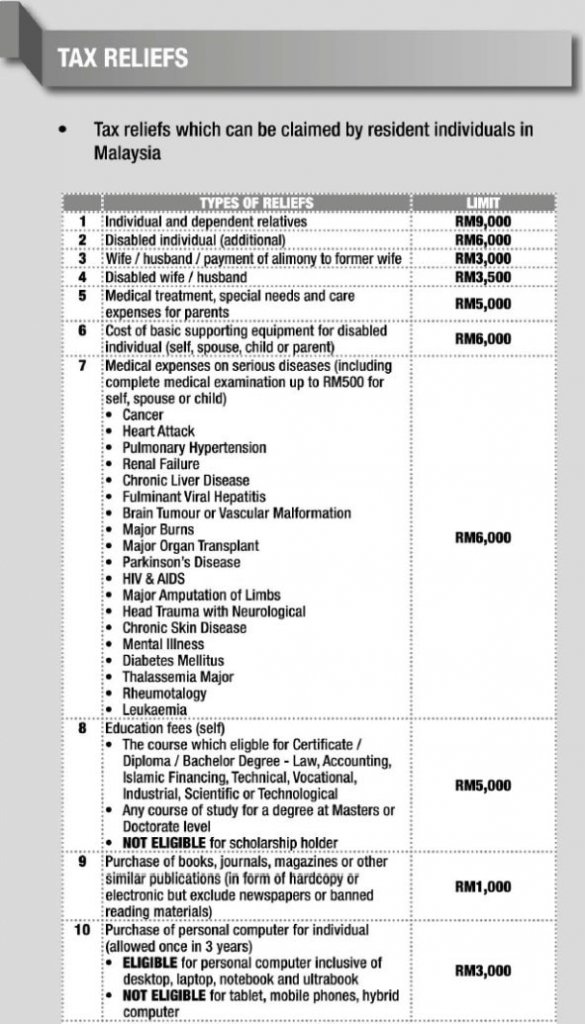

Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. Malaysia income tax e filing guide. Tax reliefs which can be claimed by resident individuals in malaysia for ya 2019 and 2020.

For example let s say your annual taxable income is rm48 000. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. What is tax rebate. Do also take note.

This relief is applicable for year assessment 2013 and 2015 only. Medical expenses for parents. In the event the total relief exceeds the total income the excess cannot be carried forward to the following ya.